OPTITOKEN

OptiToken is a hyper-deflationary cryptocurrency, supported by an automated tokenized portfolio that utilizes professional trading techniques and economic strategies for token value optimization like strategic buy pressure and supply scarcity.

The project aims to create profits from this ongoing series of trades and infuse it into the market(s) of OptiToken itself to provide constant sporadic upward price pressure. The tokens purchased are then destroyed by sending them to an unspendable address to create ever growing scarcity in the token supply and disallow the tokens from re-entering the ecosystem as ‘sell pressure.’ The remaining OptiTokens will gain value each time this cycle occurs.

Diversity: An expertly curated and diversified portfolio of cryptocurrencies used to jet-fuel a singleCryptocurrency in a deflationary manner. Opti will be traded on at least one major exchange.

Algorithmic trading: Exposure to an algorithm that has consistently outpaced Bitcoin. Developed by crunching data from the work of experienced traders. Will integrate machine learning.

24/7 Algorithm: Crypto doesn’t stop and neither will OptiToken. Constant, round the clock automatic trading to identify trends in order to support the currency.

Buy pressure: In every automatic buy cycle, a portion of the profits created will be used to buy. OptiToken on the market thus providing upward price pressure.

Strategic Scarcity: 100% of the tokens bought back will be sent to a provably unspendable address that can be verified transparently. OptiToken will be the first project to use this strategy for the purpose of raising value for adopters. It will in effect be the first hyper-deflationary currency in history.

Transparency: The portfolio will be externally audited on an annual basisand as needed to maintain integrity for OptiToken. All movements can be tracked and verified using the blockchain.

Problems and Solutions

Problems with Automation

The major problem to date is failure of robust and consistent safety measures. For example, in 2012

Knight Capital lost a total of $440 million dollars when its stock trading automation accidentally sold all the stocks it had bought a few days prior.

Optitoken’s theory on prevention of such events is to split the actively traded portfolio into smaller groups based on different fail-safe measures and also different strategies. A portion being left to human trading and rebalancing. Furthermore, OptiToken seeks to create customized solutions by working with the exchange itself to implement backup fail-safe measures and controls.

Problems with Machine Learning Implementation

The major idea that spurs development is to implement machine learning based on social network and media events. We believe this to be a fundamental flaw for several reasons.

• The case is more often than not that once an event is in the "news" it is too late to partake in a particular trend. In the team’s experience this is very common, and chasing trends is never a shrewd trading strategy. However, one may still answer, what if you programmed to”sell the news?” The problem here is that any machine in this day and age is not sophisticated enough to weigh the importance or relevance of any particular headline. It would be reckless to try to game this strategy in a contrary manner.

• With little to no regulation in place as of now, headlines can be manipulated too easily to supply concrete data to quantify or execute actions for. Not to mention the presence of propaganda social media accounts and social automations. An automation set to track increase in the posting of a particular cash-tag such as "$NMC" may be adversely affected by one individual acting as many, through the implementation of multiple fake accounts programmed to promote said coin in some public manner on the social media platform.

OptiToken’s Solutions

OptiToken is actively researching mechanisms peculiar to the space and will eventually implement learning patterns and behavior based on cryptocurrency metrics such as mining, transaction volume, hashing power movements, mempools and more. We believe these fundamental numbers tell the story of true sentiment and can be acted upon in small sized trades to "squeeze profit." We believe that this

type of trading is best when done only with a small portion of portfolio as to hedge against its inherent risk, yet still allows accumulation of significant profit over time.

Token and ICO Details

OptiToken(OPTI) is an ethereum ERC20 token, which derives its value from an underlying portfolio and the price support created through careful buy pressure induced by buying OptiToken directly on listed exchange(s) with the profits of trading said portfolio.

The ICO is scheduled for April 2018

(ICO) Initial Coin Offering

Sales Period: Q2 2018

Token Type: ERC20,

Blocklet Etereum Maximuim Supply: 280.000.000 OPTI

Available for Purchase: 196.000.000 OPTI

Hard Cap: 24,000,000 Euro

Soft Cap: 225,000 EuroNo new coins will be created or mined after ICO is complete, All remaining unsold tokens will be destroyed.

Token Distribution

Public sales: 70%

Team: 14%

Future Developments and Talents: 4%

Investors: 2.5%

Bounty and Airdrop: 5%

Adviser: 2.5%

Law: 1%

Security: 1%

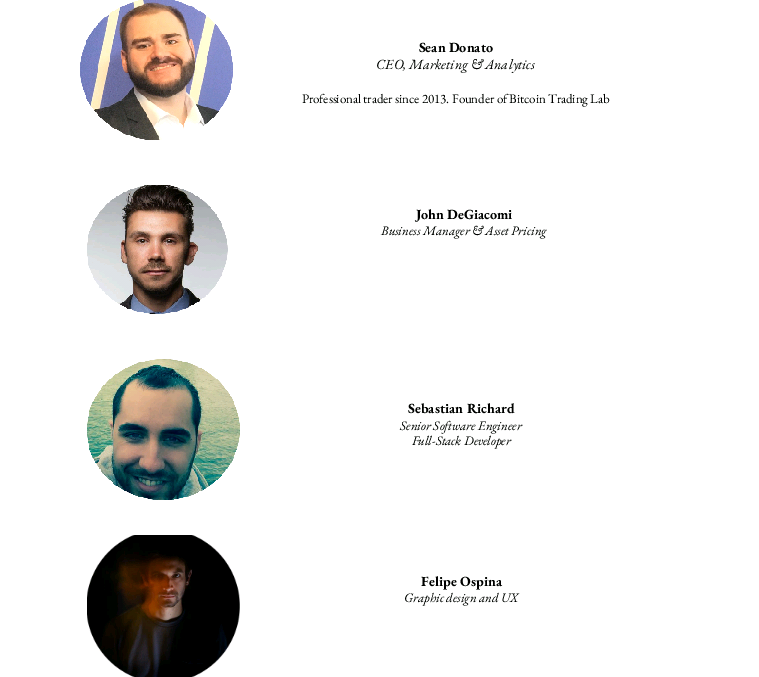

TEAM

For more information please visit the links below;

Website: https://optitoken.io//

Whitapper: https://optitoken.io/White_paper.pdf

Telegram: https://t.me/joinchat/Cif2ylI6SNVwxLXHAETG0Q

ANN thread: https: // bitcointalk. org / index.php? topic = 2974794.0

Author: BrainerdPaul

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=1680409