Will the next financial crisis sharply increase the demand for Bitcoin?

In public consciousness and in economic practice Bitcoin becomes a perspective alternative means of saving. So far, gold is the main "safe heaven" during the turmoil. So, the price of this precious metal has more than doubled during the previous crisis. At the same time, cryptocurrency is gaining momentum. What will happen during the next crisis?

Financial crises occur once in about a decade and are common in the economy, because they are closely related to its cyclical nature. In 2008-2009 the strongest financial crisis has shaken the whole world. Its consequences are witnessed up to this day in the form of huge national debts of the countries of the world. About 10 years have passed after the last global upheaval, and now JPMorgan Chase warns about the high risk of such an event by 2020. So the deadline’s getting serious.

Bitcoin appeared at the peak of the previous crisis and was the answer to the government's inability to ensure the stability and transparency of the global financial system. By the time the next financial crisis begins, cryptocurrency has chances to become an important means of saving capital from shocks.

What’s the basis for this?

Countries with high level of inflation and mistrust to the traditional financial system are in great demand for cryptocurrency.

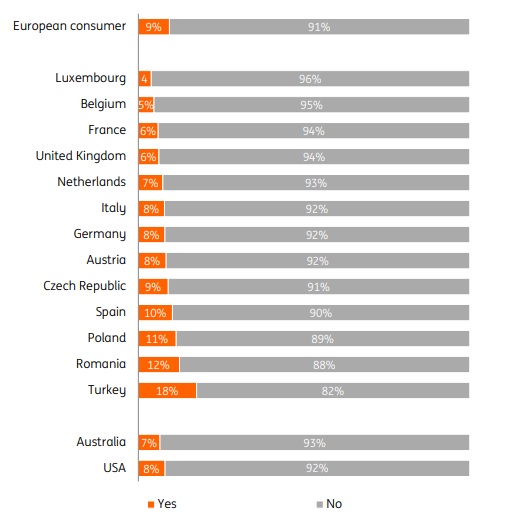

For example, according to the financial group ING, the highest level of acceptance of cryptocurrencies in Europe is observed in Turkey. In this country, there are twice more holders of cryptocurrencies as compared to the average in the countries of Europe and the United States.

This data correlates with the low confidence of the people of Turkey in the financial system of the country. Threefold devaluation of the lira during the last 4 years and high inflation has fueled interest in alternative savings.

The exchange rate of the Turkish lira against the US dollar (Bloomberg):

A similar situation is observed in other countries where there are problems in the economy (from Venezuela and Argentina to Zimbabwe).

If we assume that a similar reaction will be observed globally, this could lead to a significant increase in the price of the cryptocurrency. So, during the last crisis, the demand for gold increased sharply and from the end of 2008 to 2011 the price of the metal has grown 2.5 times. Perhaps Bitcoin might act this way too.

Many properties of gold and Bitcoin (mining, the exhaustibility of resources) are similar. Of course, globally, the cryptocurrency still needs years to become a full-fledged alternative to gold, but in relation to physical metal, Bitcoin has significant advantages. It can significantly strengthen its position during the next crisis. First of all it is:

Availability. There is no need to pay for transportation and storage. In order to buy and sell, you do not need a large network of intermediaries;

Technological nature. Studies show that the generation of millennials is not fond of luxury goods and precious metals, and has no understanding of its value. But they understand and accept the nature of Bitcoin. Most of Bitcoin holders belong to this generation;

Adoption as a measure of values. Just like the dollar is a measure of value for tangible assets, Bitcoin becomes a measure of the value of intangible assets. These can be other cryptocurrencies, ICO tokens and a wide variety of tokenized property rights. No one has measured anything in gold for a long time already.

Andrey Mastykin, cryptocurrency analyst of Electrus