HOMELEND - Is a platform that enables the next generation of decentralized homebuyer mortgage financing, ICO Review

Hello and Greetings my dear subscribers !!!

I present to you a very interesting project.This project is unique and technological.The platform has no analogues.And look at the investment potential and everything will become clear to you at once.Well that regular? Meet the Homelend project . Homelend is a decentralized platform that allows you to Finance next-generation mortgage lending. Homeland creates an interface for direct interaction between borrowers, lenders and other parties involved in the mortgage value chain. Thus, it provides a mortgage reverse investment using a peer-to-peer model with security, transparency and automation provided by distributed book technology (DLT) and smart contracts.

The Homelend Advantage:

From manual, lengthy, streamlined & Efficient

- Embedding pre-defined business logic into smart contracts, digitizing documentation and eliminating unnecessarily processes, Homelend will automatically execute an end-to-end origination process, cutting it down from 50 days to less than 20.

From Ambiguous, clunky to Transparent & user friendly

- Homelend aims to create a lending process that is not only smart, but also simple and fair. It will enable borrowers will be able to easily apply for a loan, track their application status at all times and interact directly with mortgage lenders.

From Costly Intermediation to Cost Effective & Middleman Free

- The immutability, security and transparency provided by DLT makes it possible to record transactions, including loans, without banks acting as middlemen. This will reduce costs for both borrowers and lenders, while minimizing the distance between them.

From Vulnerable, Unreliable to Trusted & Secure

- Centralization and paper-based processes are the key factors behind the insecurity and vulnerability that characterize the traditional mortgage industry. The unique characteristics of DLT and smart contracts enable Homelend to provide a platform for people to transact large amounts of money in a trusted, transparent, and secure way.

MORTGAGE LOANS BASED ON THE COMPANIES

Having a home is one of the basic human needs - a need that most people can afford by taking out a mortgage from a Bank. More than 8 million mortgages are issued annually in the United States alone.

By embedding pre-defined business logic into smart contracts, digitizing documentation, and eliminating unnecessary processes, Homelend automatically executes the end-to-end creation process, reducing It from 50 days to less than 20.

How it works in platform?

Connecting the borrower and lenders in a unique way, which is controlled by smart contracts, without involving intermediaries. Borrowers will apply for a mortgage loan through the platform Homelend's. These applications will be examined and approved (or not) with the help of machine learning and artificial intelligence technology. Then, each lender will be able to finance a pre-approved loan by purchasing "Iris " from them. All processes will be controlled by the contract smart Protocol, not by humans. In the Homelend's platform, information gathering is done in a way that's "all digital ". Even the data are in the paper-based documents should be transferred to the digital repository technology-based distributed ledger. This data is provided by the user and checking through the professional verification provider.

Financial flows in the Homelend, the flow of financial resources from lenders to borrowers (and, ultimately, for the seller) is run purely by smart contracts. There are financial services, control or the taking of decisions by Homelend.

After the buyer receive pre-approval from the system, regarding a specific property, mortgage loan according "registered " on a Homelend's platform. Thus, the borrower has committed a specific face, and the amount of the credit is determined.

Business model used

Is being developed as a blockchain solution that significantly will increase housing financing possibilities for many individuals and families. Our value proposition to sensitive social and progressive approach anchored in P2P that aims to use technology to benefit society. Nevertheless, Homelend is also based on a sound and profitable business models, who are aware of reaching underserved market address. On the one hand, Homelend creates an investment opportunity for many individuals, with solutions that unite the traditional industries as real estate, with innovative technology such as blockchain. On the other hand, it makes it possible for many individuals (who due to various circumstances, including the current limitations in the traditional credit risk models do not have a solid credit score, but otherwise good) for access to financing housing and solve one of their most basic aspirations: own a home of their own.

About Token

HMD token is the fuel powering the Homelend peer-to-peer lending platform. The main function is to provide access to the Homelend platform.

Token this utility also plays an important role in enabling a fast, smooth and user-friendly unified workflow and secure.

All Token can be converted to and from the HMD.

The symbol : HMD

The number of supply : 250 million +

The standard : ERC-20

Face value : 1 ETH = HMD 1,600

The currency : BTC, ETH, USD

Softcap : US $5 million

Hardcap : US $30 million

Their team is very strong and professional to build this project

Executive Team

Itai Cohen Chief Executive Officer

Netanel Bitan Chief Technology Officer

Ricardo Henriquez, Chief Innovation Officer

Amir Nahmias business officials

Develop team

Michael Tanfilov Director of strategic planning

Kanat Tulbassiyev Blockchain leading developers

RAM Stivi Backend developer

Graphic designer Quijano Sol Alvarado/Assistant community

Vinod Morkile Blockchain developers

The Advisory Council

Eliran Madar business development/Investor relations

Joram Uzan entrepreneurs

Moti Friedman marketing consultant

Danny while assessment

Raghuram Bala analysis technology Executive

Ido Samuelson Blockchain Expert Advisor

Marc Kenigsberg Tokenomics Advisory and Data management

Business growth Advisor Haham Adina

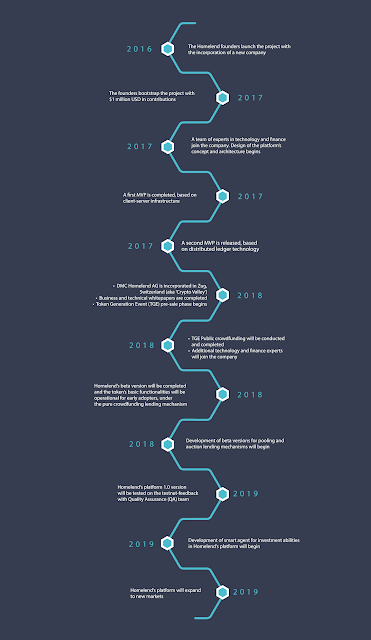

Roadmap

More information, visit the link below:

Website: https://homelend.io/

WHITEPAPER: https://homelend.io/files/Whitepaper.pdf

Twitter: https://twitter.com/homelendhmd

Facebook: https://www.facebook.com/HMDHomelend/

TELEGRAM: https://t.me/HomelendPlatform/

MEDIUM: https://medium.com/homelendblog

LINKEDIN: https://www.linkedin.com/company/18236177/

Reddit: https://www.reddit.com/r/Homelend/

Thank you very much for visiting, and have a nice day !!!

Best regards,

Supertar

Author profile:

https://bitcointalk.org/index.php?action=profile;u=1859198

My wallet address:

0x23E3145Ecf3ffb6390DE807B97263AA9Cf3A9b36