Distributed Credit Chain - The Platform That Empower Credit and Enable Finance

Hi friends, let me let you in on an incredible news! It's Distributed Credit Chain - The Platform That Empower Credit and Enable Finance!!!

But before I take you on this voyage, check out this video presentation made by the CEO himself.

PRESENTATION

A storm has hit the investment market which we are not going to recover from. Crypto investment is that storm. With strict capital controls in place by most countries to control the flow of money and charge high taxes, cryptocurrency gained usage in circumventing capital controls and taxes, leading to an increase in demand. Cryptocurrency has been able to present an easy to use digital alternative to fiat currencies. Offering frictionless transactions and inflation control, investors have been prudent enough to add these currencies in their diversified portfolios as an asset, as the size of the market does not represent a systemic risk. Cryptocurrency employs the use of cryptography that assures high-security processes and verifies transactions personal to each user. Hence, counterfeiting and anonymous transactions are impossible to achieve.

While this revolution is gaining wide acceptance, Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world has arrived.

Now that I have your attention, let’s get right to it.

NB: Most of the details from this article was gotten from the official website and whitepaper of Distributed Credit Chain

Stay tuned as we move along!

What exactly is Distributed Credit Chain?

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

THE MISSION

By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

A core supply chain will be established — DCCs to set business standards, unify the books, execute business contracts, implement payment and payment services, etc.

The project team hopes that after a long period of development (from 5–10 years) the banking system will be able to become an important node of new finance, and traditional businesses can Participating in distributed business ecosystems through distribution banks.

The project will commence credit business on the DCC, and rebuild the business ecosystem of traditional credit through decentralized thinking and distributed technology.

The Problems

The traditional financial industry is highly centralized. Financial transactions rely heavily on the endorsement and support of large financial institutions, with substantial transaction fees paid out to these institutions. Monopolistic financial institutions have in fact raised lending rates for borrowers and reduced the interest income for lenders.

Cost: The core model of a credit agency is to share the costs of non interest-earning elements and bad debts by charging the "good guys" who can pay back the money. For borrowers, it brings an additional cost.

Efficiency: From the credit agency's perspective, a lot of time and efforts are wasted in verifying the credit of borrowers who do not meet the agencies’ risk criteria, which leads to wasting resources and decreasing efficiency.

Profiteering: A centralized credit model entices many financial institutions to deviate from their primary purpose— serving customers. Aiming for profitability, they deduct lenders while squeezing borrowers, and expand their profits by extending their customer base.

SOLUTION PROVIDED

Borrowers

Individuals with specific borrowing demand establish blockchain account to authorize data service provider and Initiate borrowing request

Data Service Provider

Integrate individual data and store them on the chain, clean dirty data, and provide data standards

Algorithm & Computation Service Providers

Extract characteristics from data, make judgments based on policies and quantify judgment based on characteristics

Credit History Feedback

The approved credit history reports generated on blockchains prevent problems such as long-term borrowing and repeated test borrowing.

Funding Providers

Not directly involved in lending but provide funding (such as ABS-purchasing institutions).

Risk Assuming Institutions

Operate a credit business by earning income from bearing specific risks, manage loans in progress and collect after loan

ADVANTAGES

Break the Monopoly

With a global distributed banking ecosystem, DCC aims to break the monopoly of traditional financial institutions and to return earnings from financial services to all providers and users involved in such services so that each participant may share the return of ecological growth. distributed banking will ultimately be a way to truly achieve an inclusive system of finance.

Decentralized Thinking

Through decentralized thinking, distributed banking will be able to change the cooperation model in traditional financial services, building a new peer-to-peer and all-communications model of cooperation across all regions, sectors, subjects and accounts.

Transform Business Structure

As it pertains to business, distributed banking will completely transform traditional banking's debt, asset, and intermediary business structure. The tree-like management structure of the traditional bank will thus evolve into the flat structure of a decentralized bank, establishing distributed standards for various businesses and improving overall business efficiency.

Government Regulation

As it pertains to regulation, the fact that all records registered in the blockchain cannot be tampered with will enable regulators to penetrate the underlying assets in real time. Big data analysis institutions will also be able to help the regulatory bodies understand and respond to industry risks more quickly based on blockchain data analysis.

DCC ECOSYSTEM

DCC is the credential used to pay for jobs in the Distributed Credit Chain. Any work in the DCC needs to be paid for with DCC. DCC balance is managed through DCC token contract to maintain a fixed total amount of DCC. As the financial service system in the DCC grows, more and more distributed business scenarios are embedded and used more frequently, which greatly increases the liquidity.

DCC's payment is handled based on the DCCpayment contract, which is responsible for the DCC payment rules for multi-payer participation.

DCC Key Features

Redistribute Ecosystem Benefits

The loan application is rejected, then the reward is assigned to lending institutions.

DCC amount paid for loan application is decided by the borrower at own discretion, and credit institutions can set the minimum threshold of DCC and handle the priority of borrowers’ applications. In principle, the credit institution will give priority to borrowers who pay more DCCs.

Through establishment of such decentralized trading models, the entire ecosystem distribution pattern of interests can be dynamically adjusted so that the credit processing resources can be tilted towards individuals with more DCCs (those who contribute more to the ecosystem), thus maintaining the sustained vitality of the ecosystem.

Incentivize Credit Accumulation

In the DCC system, a portion (for example, 2.5%) of the loan in the application process is converted into the credit pool of the day and forms the total reward pool with ecosystem fixed incentives. According to DCCreward Agreement, on Day T+1, the money in credit reward pool will be distributed evenly to incentivise borrowers who repay loans before Day T. In the DCC ecosystem, different types of reward pools will be formed in different businesses in the future, and ecosystem participants may receive incentives for different pools when using and contributing to different ecosystems.

The daily fixed incentive is dynamically adjusted by the foundation according to ecosystem development needs, and daily fixed accumulation will not exceed the total amount of DCC. When there is no DCC that can be excavated, the incentives will be no longer given.

DCC incentives ensure that good credit behavior can obtain more convenience in lending, which encourages everyone to establish their own good credit.

Cross-border Credit Credentials

Because the DCC system provides a cross-border, cross-scenario, and cross-currency credit service of digital assets, DCC can correspond to values of different legal tender of loans in various countries, which greatly facilitates the multinational business of lending service agencies.

Being more frequently used, DCC is expected to become the anchor currency of the multinational lending service ecosystem on Distributed Credit Chain, and open the value exchange of ecosystem service providers in various countries. Through DCC, users in one country or scenario will be able to purchase data reports provided by the data providers of another country or scenario, or apply for loans from various lending institutions in different countries. DCC transactions in different exchanges corresponding to different currencies can provide cross-border settlement services.

TOKEN AND ICO DETAILS

The Token Sale will fund the development and adoption of the DCC platform.

Token name: DCC

The total supply of ERC20 tokens will be 10,000,000,000.

In the private round , famous qualified investors in the fields of credit and banking will be invited for the investment, with the fundraising percentage no more than 18%, and the investment amount of single investor no less than 100ETH. At this stage, DCCs will be locked, with 25% of the total to be unlocked before the opening of exchange, and another 25% to be unlocked every two months, with the full amount to be unlocked in 6 months.

In ICO round, 200,000,000 DCCs will be issued to Non-Chinese and American investors. All these will be directly circulated. DCC token will be exchanged by ETH. The contributions in the token sale will be held by the Distributor (or its affiliate) after the token sale, and contributors will have no economic or legal right over or beneficial interest in

these contributions or the assets of that entity after the token sale. To the extent a secondary market or exchange for trading DCC does develop, it would be run and operated whollybindependently of the Foundation, the Distributor, the sale of DCC and Distributed Credit Chain. Neither the Foundation nor the Distributor will create such secondary markets nor will either entity act as an unlocked in 6 months

Token Distribution

Use of Proceeds

ROADMAP

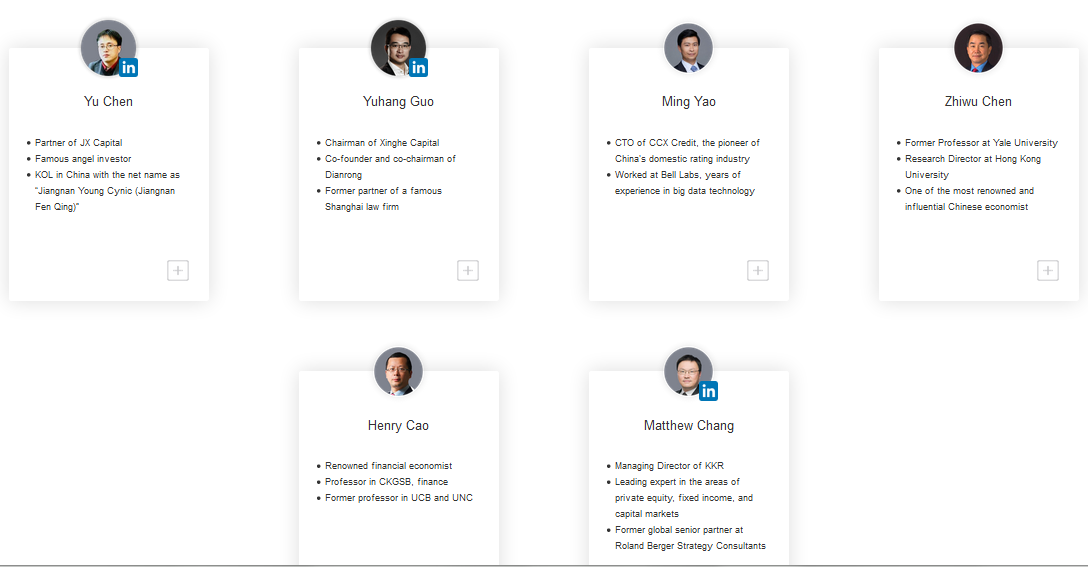

MEET THE AMAZING TEAM

PARTNERS

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Facebook: https://www.facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Telegram: https://t.me/DccOfficial

Bountyguru Username: TheMichaelMatch

Author: TheMichaelMatch

My BitcoinTalk Profile: https://bitcointalk.org/index.php?action=profile;u=1326035

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.