TON ICO Report | Обзор ICO проекта TON

Written by dzhikar

The information contained in this report is neither legal nor financial advice and presented for informational purposes only. The projects included in cyber•Fund reports vary significantly in terms of investment risks. Before considering any investment, make sure you read the report below carefully and take time to do your own due diligence.

The TON project is a general purpose scalable Proof-of-Stake (PoS) based multi-blockchain and network created to turn cryptocurrencies into mainstream means of payment. The goal of the project is to create a scalable infrastructure for decentralized services by integrating TON with Telegram through Gram cryptocurrency. The TON blockchain claims to be scalable for a mass-market adoption and support smart contracts; Telegram brings a large and engaged user base. The TON Foundation and the TON Reserve will oversee and control the deployment of the project in its initial phases; after 2021 they will be abolished and the TON will become completely decentralized. At the moment of publication the Telegram Open Network Pre-ICO is over with the total amount of $850,000,000 raised from 81 investors (see Form D filing of February 13th). RBC and Bloomberg report that there will be another two private investment rounds targeting $3 billion in total. The founders refrain from responding to any queries about the project, and the available information comes from the leaked technical whitepaper and media; its reliability is questionable. Neither code, nor Minimally Viable Product have been revealed.

About

The Telegram Open Network (TON) is a Proof-of-Stake based, scalable multi-blockchain and network project aimed at accommodating a mass-market cryptocurrency and a range of decentralized applications by allowing third-party integration and supporting “arbitrary code” (smart contracts). At present, the widespread adoption of cryptocurrencies for the purposes of everyday transactions (including micropayments) is hampered by technological and user-related barriers that TON intends to remove:

- Technological limitations of speed and scalability adversely impacting performance and thus hindering the mass-market adoption of cryptocurrencies, including the most popular ones like Bitcoin and Ethereum, as well as others;

- Unintuitive design provoking users’ confusion;

- Limited tradability of cryptocurrencies for mainstream goods and services and the lack of an engaged demand from the general public (as opposed to qualified investors).

The project aims at removing these obstacles by (1) proposing a scalable and high-performing multi-blockchain architecture able to accommodate previously unprecedented volumes of transactions; (2) developing user-friendly accessible interface for value storage and exchange, and the means for such an exchange (Gram cryptocurrency also known as GRM or TON Coin); (3) effecting an integration of TON with Telegram to leverage the latter’s 170 million active user base, as well as related infrastructure of communities, developers, businesses and applications with future growth potential (estimated at 500,000 new users daily). Telegram will be just one but crucial integration case, as its large and engaged user base could create the necessary demand for a widespread adoption of cryptocurrencies, thereby making them comparable to such mainstream payment services as VISA and MasterCard.

The TON acronym stands for Telegram Open Network. According to the timeline of the project, Telegram will help TON to take off, and after 2021 the network will become completely decentralized, with a corresponding change of the name to The Open Network. At the moment, however, no code has been released, and the project is implementing Telegram Secure ID, a universal “virtual passport” used for user verification across Telegram services, the first step towards the establishment of the TON Network, according to the timeline published in the whitepaper. The founders promise to return funds raised back to investors, should the project fail to create a blockchain with a built-in cryptocurrency by late 2019.

Technology

- Infinite Sharding Paradigm: The TON blockchain is a collection of meta-blockchains, or 2-blockchains, including: a master blockchain containing up to 2^32 heterogeneous workchains (with different “rules”), each consisting of 2^60 homogenous shardchains (with common “rules”). Every shardchain is also a blockchain of blockchains, or a 2-blockchain. This design allows TON to split and merge automatically to accommodate dynamics in transactions load, ensuring high performance at the scales of mass-market adoption.

- Instant Hypercube Routing: Each shardchain consists of logical blocks or “accounts” (smart contracts) that exchange messages bearing value and information. This feature enables TON to deliver and process messages by matching the sending and the receiving blocks in shardchains, regardless of the total quantity of shardchains in the system, i.e. independently of the system’s size. This solution ensures high speed of the processing even at large scales.

- Self-correcting mechanism: Because each block in a shardchain is also a blockchain (normally consisting of exactly 1 block), they have both “vertical” and “horizontal” dimensions. This allows to create new “vertical” blocks on top of any incorrect block, enabling an efficient self-correcting mechanism without making unnecessary forks and ensuring that valid transactions will not be cancelled because of unrelated errors.

- TON Virtual Machine (TVM): TON supports smart contracts (“arbitrary code”) through its Virtual Machine that executes smart contracts in the master blockchain and the basic workchain. TVM supports the “TVM assembly” language, as well as several high-level languages that can be designed for it. The founders specify that they will be static types-based and support for algebraic data types. Possibilities include: Java-like imperative language with separate classes for each smart contract; functional languages like Haskell or ML.

- Consensus mechanism: TON is based on a Proof-of-Stake approach to consensus across the blockchain, whereby the processing nodes (validators) deposit stakes in Gram cryptocurrency. This ensures the validators’ dependability and focuses the computing power available throughout TON on processing transactions and smart contracts, thereby achieving further increases in efficiency.

- Configurability: many of TON’s parameters can be changed by certain transactions involving proposals, voting, and results. These transactions take place within the masterchain and thus proposed changes do not require hard forks. To implement changes of parameters requires collecting ⅔ of validator votes and more than 50% of the votes of other participants in favour of the proposal.

Platform participants

- Validators. Because TON blockchain uses Proof-of-Stake approach, there is no “mining” in the strict sense; instead, the validators spend their computing powers (as well as disk space and bandwidth) to process and store the network’s requests and data. Validators are in charge of creating and propagating new blocks into the masterchain by depositing stakes in Gram cryptocurrency. They obtain income through transaction fees (and payments for gas and storage), as well as some portion of the newly minted coins. Validators’ stakes are expected to increase at 20% per year. There are also sanctions for validators’ mistakes: they are not paid for signing invalid blocks and can lose parts of their stakes or validator status if they don’t validate new blocks for a long time. The total number of validators is limited by approximately 1000 nodes.

- Nominators. The TON blockchain has a system where users can lend Gram cryptocurrency to each other to become validators. The nominator (the lender) can then share some portion of the validator’s rewards, but also a risk associated with the possibility of validator’s mistakes. This is also a measure against monopolization of validating activity by the owners of large stocks of Gram cryptocurrency.

- Fishermen. Any node of the network can become a fisherman by making a small deposit in the masterchain and publishing invalidity proofs of some blocks signed by validators. Upon agreement of other validators on the block’s invalidity proved by a fishermen, the latter will receive some portion of the coins taken from the mistaken validator as a punishment. To become a fishermen one does not need as much computing power as for being a validator; however, the assumption is that fishermen will mostly be would-be validators who did not yet acquire enough computing power or Gram cryptocurrency.

- Collators. Any node of the network can also become a collator by suggesting new blocks to be proved by validators and acquiring some portion of the validator’s rewards in return. Essentially, the collators are paid for their monitoring activity; validators can outsource that to collators, but the assumption of the founders is that during the initial stages of the system’s deployment all validators will also be acting as collators.

- Users. TON blockchain serves as the infrastructure for multiple services described below.

Platform use-cases

TON is a highly complex project allowing for multiple use-cases. These can be roughly divided into uses related to the core structure of the TON (network + blockchain); uses related to Telegram’s existing ecosystem; uses of the Gram cryptocurrency; and the uses of specific applications (Telegram Secure ID and Light Wallet).

The TON project combines the following components:

- A peer-to-peer network (TON P2P Network) that enables access to the blockchain and supports arbitrary decentralized services and applications;

- A distributed data storage technology (TON Storage) accessible through the TON Network and used for the data-storage needs of the blockchain, but also available for arbitrary uses by customers and service providers; it is based on a torrent-like access technology and is a necessary infrastructure for implementation of more complex decentralized services (e.g. video storage like Youtube)

- A network proxy/anonymizer layer (TON Proxy) allowing to hide the identity and IP addresses of the TON Network nodes; it can be used to create blockchain-based alternatives to TOR and decentralized analogues of VPN, allowing to achieve effective immunity to censorship and protecting the privacy of the services;

- A platform for arbitrary services (TON Services), available through TON Network and TON Proxy with a user- and service provider-friendly interface, acting like a browser or a smartphone interaction. Services can create smart contracts in the blockchain and use them in the interactions with customers;

- TON DNS, a service assigning human-readable names to accounts, smart contracts, services and network nodes. It allows to access decentralized services in a manner similar to using a WWW browser;

- TON Payments, a micropayments platform and channels network that can be used for both on- and off-chain value transfers, including payments for the TON Services.

- All these services support integration with a range of third-party applications, both centralized and decentralized.

- The existing ecosystem of Telegram allows for the uses of bot platform, with bots able to accept credit card payments, to be further developed so that they can act as service providers accepting cryptocurrency payments; groups and channels that can be monetized for promotion and advertising services; Telegram’s in-app economy that will support exchanges of digital and physical goods and services;

- Telegram will also create a searchable registry of decentralized services, based on which it will be able to determine the most popular apps and analyze users’ choice histories, thus offering marketing services and acting like Google Play and App Store for decentralized applications;

- The Gram cryptocurrency also involves multiple uses, most importantly payments for the key actors within the blockchain (e.g. validators) for their work of processing transactions, as well as payments for TON Services, and payments for the services of users’ application, including delivery of physical goods;

- Telegram Secure ID will be implemented in the first quarter of 2018, providing users with a universal “virtual passport” to be used for access to different services that require user verification; all the users’ data will be protected by end-to-end encryption, and the services and applications will not have access to the data, but only to the hash values needed for verification; third parties will be able to add further verification/security procedures if necessary;

- Light Wallet will be integrated with TON and Telegram mobile and desktop applications, thanks to the TON’s ability to support light wallets that do not consume significant resources; the wallet will enable exchange and interaction with smart contracts in a streamlined fashion; the owners will be the sole holders of the wallet’s keys.

The Market

According to the technical whitepaper, TON is a scalable general purpose blockchain capable of accommodating any blockchain-based applications. This section focuses on the first proposed case of such integration -- Telegram -- whose success (or failure) will likely impact further integration attempts in the future.

The marketability of the TON project comes down to the success of the three related applications: the Telegram-integrated cryptocurrency wallet (Light Wallet, to be launched in Q4 2018), a take-off of the TON blockchain-based economy (scheduled to Q1 2019), and the adoption of the TON Services by providers and users (to be launched in Q2 2019).

The Light Wallets will be built into Telegram applications, providing the users with conventional functionality to secure value storage, transfers, and interaction with the TON blockchain and its applications. The owners of the wallet will be the sole holders of the private keys, and Telegram mobile and desktop applications will be fully integrated with the wallets. The in-house economy of Telegram will be powered by Gram cryptocurrency (see below), which will also permit external uses.

Within Telegram, the wallets can be used to spend tokens for cryptocurrencies exchange via bots; to monetize large groups and communities via advertising; to make payments for publication of content (donations) and for purchasing of physical goods; finally, the founders also aim at introducing the analytics functionality similar to Google Play and Apple Store that will allow to track users’ choices histories, thus fueling the creation of an applications market.

In sum, the size of the potential market can be roughly estimated by the number of Telegram’s active users with the necessary adjustments regarding the growth rate.

Competitors

By virtue of its novelty, TON does not have direct competition from other blockchain solutions. The technical whitepaper makes some tentative comparisons, including such projects as Bitcoin, Ethereum, NXT, Tezos, Casper, Bitshares, EOS, PolkaDot, and Cosmos (see Table 1). The latter three are the closest matches to TON in terms of several key features: they belong to the 4th generation of blockchains, support smart contracts, and use multiple blockchains. However, TON stands out by virtue of its support for dynamic sharding and mixed multi-chains (both homogeneous and heterogeneous), and tight coupling of the blockchains. With respect to these features, the project is truly unique as of yet. Some other strengths of the TON include its affiliation with Telegram which has an established brand and was named the most popular messenger in the crypto-community (by Forbes); the skills of the team; and the fact that it raises fiat money and mostly from traditional, non-crypto investors.

However, given the ambition of the founders proposing that TON could become an analogue of VISA/MasterCard for cryptocurrencies, it can suffer competition from these established payment systems. Because TON intends to leverage Telegram’s existing user base, it will also suffer from Telegram’s competitors in some regions where Telegram is less prominent (like China where users generally prefer WeChat). While difficult to predict, in general, the competition will depend on the rates of adoption that can be unrelated to the project’s functionality (e.g. due to QWERTY-effects and technological lock-ins).

Economics and Token

- Token: Gram cryptocurrency also known as GRM or TON Coin.

- The initial supply of Gram cryptocurrency is limited to 5 billion Grams. The expected inflation rate is estimated at 2% annually, representing the rewards to validators. Accordingly, the supply of Gram cryptocurrency will double in 35 years. Unallocated Grams will be used for the purposes of voting. The TON Reserve will hold approximately 5 x 10^9 units of Gram cryptocurrency during the project’s initial stages (that is, up to 2021) in order to ensure sufficient voting power to develop the TON project and to finance its operational expenses.

- Gram cryptocurrency will be used as a means of exchange within the Telegram-based apps economy, as well as for external uses.

- The uses of Grams can be divided into three broad categories detailed in the list below: (a) financing the operation and maintenance of the network (transaction costs); (b) payment and value storage means in the TON-based economy (payments for goods and services); (c) payments for the specialized services provided by TON:

- Commissions (in “gas”) to the validators as a reward for processing transactions and smart contracts;

- Depositing stakes of the validators to become eligible to create new blocks and mine coins;

- Lending capital to validators for a share of their reward;

- Voting power to partake in collective decision-making regarding possible changes in the protocol’s key parameters;

- Payments for services provided by the platform-based applications (TON Services); secure data storage services (TON Storage); registration of the new blockchain-based domain names and hosting TON-sites (TON DNS and TON WWW); IP addresses and identity hiding, as well as for escaping the censorship of the local Internet services providers (TON Proxy).

- Further details on pricing and circulation of GRM can be found in the Appendix of the technical whitepaper.

ICO

- Token for sale: Gram cryptocurrency.

- The exact supply of tokens for the pre-ICO is unknown; the whitepaper refers to it as “a bulk pre-sale of TON tokens”.

- The pre-ICO started on January 29th was concluded with $850,000,000 raised from 81 investor (according to the SEC filing). There is no public authorized information about the next stages of the ICO.

- ICO token price: $0.38. According to the recent media reports (RBC and Bloomberg), there will be three rounds, possibly taking place in March and June, before the public ICO. According to Bloomberg, in the first private pre-ICO one unit of Gram cryptocurrency was priced at $0.38, $1.33 in its second round and may be priced higher at the remaining round.Two presentations for prospective investors are now in circulation, detailing that the price of 1 Gram will be held between $1.1 and $1.45. The authenticity of these presentations was confirmed to RBC by the three investors. It is also believed that institutional investors, including venture capital funds iTechCapital and Da Vinci Capital, were taking part in the private pre-ICO.

- ICO hard cap: It is reported that TON’s capital target is 3 billion USD.

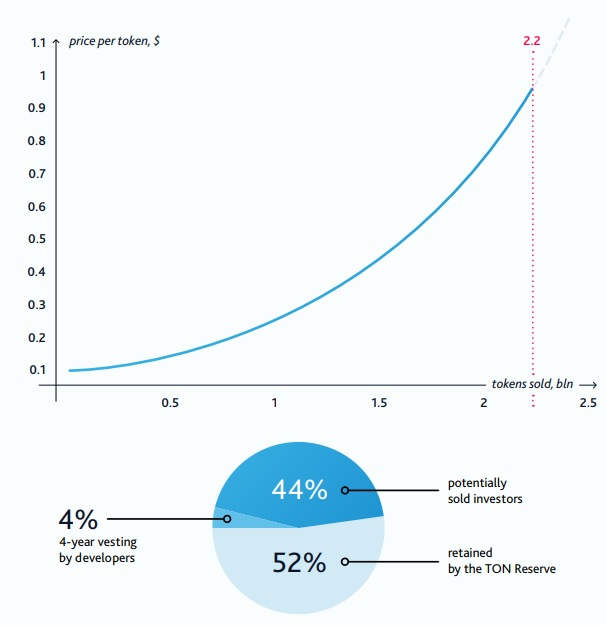

- Post-ICO token price: GRM is an exponentially-priced cryptocurrency, so that the price of the n-th Gram is determined by the following rule: pn := 0.1 × (1 + 10^(−9))^n USD. This pricing strategy will be used by the TON Reserve to keep inflation rate in check. The TON Reserve, controlled by the TON Foundation, will use unallocated Grams to control the voting during the initial deployment of the system, and control the exchange rate of Grams. The formula above links the price of Gram with the total quantity in circulation. If the market price of Gram cryptocurrency falls below the level of 0.5 x p(n), the TON Reserve can buy Gram cryptocurrency back to decrease the amount in circulation and increase the price. On the other hand, the market price of Gram cryptocurrency cannot increase above p(n) by a high margin, because in that case it would make sense to buy Gram cryptocurrency from TON Reserve directly.

- Vesting: 4% of the supply will be reserved for the developers with a 4-years vesting period.

- Token Distribution

- The pre-ICO supply is unknown; the total supply of Gram cryptocurrency is originally limited to 5 billion of Grams;

- 52-54% of the total supply will be retained by the TON Reserve to protect the cryptocurrency from speculative trading;

- 42-44% of the total supply will be sold to the investors.

- Use of proceeds: as explained in the whitepaper, over 80% of the funds raised will be used to finance Telegram’s ongoing expenses and support the growth of the ecosystem, including such cost items as equipment, bandwidth, colocation, user verification, wages, overheads, and consulting. Telegram’s budget projection for 2018-2020 is $400 million, and $620 million is required to achieve 1 billion of active users by 2022

Company & Legal

On February 13th, the Durovs filed a Form D (Notice of Exempt Offering of Securities), pursuant to rule 506(c) of the SEC, for the two issuing entities, Telegram Group Inc. and TON Issuer Inc. According to the filing, both entities are corporations incorporated in 2014 and 2018, respectively, and are based in the city Tortola, belonging to the jurisdiction of the British Virgin Islands (Telegram is physically based in Dubai). Pavel Durov is the executive officer and the director of both entities, while his brother Nikolai holds the position of the executive officer. The revenue range is undisclosed. According to the filing, the proceeds are intended to be used to develop and maintain Telegram messenger and to develop the TON blockchain. The type of securities offered is Purchase Agreements for Cryptocurrency. Legally, under the rule 506(c) the issuers may pursue one or more further offerings, provided they file an amended notice with the SEC. The U.S. citizens eligible to invest under these terms must qualify to be “accredited investors”: either worth more than $1 million or having $200,000 annual income. Under these terms the tokens will be exempt from registration as securities.

Team

- TON’s core team consists of the two founders and 15 developers. The founders are the Durov brothers Nikolai (the elder brother) and Pavel.

- Pavel Durov is a developer and entrepreneur. In 2006 he was in charge of developing VK.com, a social network for St. Petersburg University alumni and students, eventually becoming the largest European social network with a 70% market share in the CIS countries. Now it has over 100 millions active users. In 2013, Durov launched Telegram, a cross-platform encrypted messaging service, now used by over 170 millions globally. Since then, Durov combines the roles of the CEO and the Product Manager. He received several global entrepreneurial and leadership awards.

- Nikolai Durov is a mathematician and top-class programmer. He holds two PhD degrees in algebraic geometry (St Petersburg State, 2005 and University of Bonn, 2007), and won all major international olympiads in maths and informatics, including ACM IPC. In 2006-2013 he served as the CTO, Architect and the lead C/C++ engineer, building data storage and networking software at VK.com. Since 2013 he performs the same roles at Telegram, where he developed a customized data protocol MTProto able to work securely with multiple data-centers. He is also believed to be the author of the TON concept and architecture, both being the results of his research that culminated in the project’s technical whitepaper.

- The rest of the team consists of highly-skilled software developers with winning records in international programming contests, including Aliaksei Levin (github, IMO record), Arseny Smirnov (github), John Preston (github), and DrKlo (github). Telegram bets on olympiad coding skills with the hiring policy that requires either a victory in an international coding contest, or a first place in one of the specialized nationwide contests organized by Durov the younger. Inheriting the expertise accumulated at VK.com, the TON’s core team members have a ten years worth of expertise in building scalable distributed networks and secure data storing solutions. All networking, database and cryptographic solutions are custom-built to suit the specific needs of Telegram. More information about “other notable team members” can be found in the whitepaper.

Summary

- The TON Blockchain is a very ambitious project proposing a game-changer solution to the problem of mass adoption of cryptocurrencies. It is uniquely positioned to tackle the challenge of making cryptocurrencies into a decentralized version of VISA/MasterCard by virtue of its technical design and access to the large users base of Telegram. Potentially, the project could create a new, truly mainstream, crypto-economy. However, its ability to deliver the promised results crucially depends on the adoption of Telegram and the ability of the team to tackle the numerous challenges that may arise during the implementation.

- The team behind the TON is highly skilled and experienced. However, given the ambition of the project, even the best skills available may not be able to stand up to the challenge. Moreover, the team’s expertise is overwhelmingly technical, with Pavel Durov alone being an experienced business executive. TON’s bet on the olympiad coding skills may also prove to be a liability during the TON’s deployment phases which may require different skill sets both in programming, but also in business management. The latter part is currently lacking in the team’s portfolio.

- The economy of the TON token is well-designed, putting the TON Reserve in a central bank-like position during the initial phases of the project’s deployment, in charge of the stability of the exchange rate and inflation. However, it is impossible to predict how well it will operate before it is tested in practice.

- The TON pre-ICO stands out by virtue of the fact that it (a) raises fiat money (b) from institutional investors. While this policy could increase the project’s legitimacy outside the crypto-community, lack of transparency about the pre-ICO procedure, pricing, and participants diminishes potential reputational advantages that could be have been realized. With such fundraising policy, the founders protect the TON from cryptocurrencies’ volatility and ensure the terms of investment that minimize the risk of hostile takeover of the project by the stakeholders. The investors, on the other hand, are deprived of the transparency advantages associated with traditional crypto-ICO where the safety of the investments is guaranteed by a smart contract that returns money back to the investors if the project fails.

- The TON ICO has been repeatedly cited as the largest ICO ever. According to the media reports, the founders plan to raise as much as $3 billion during the pre-sale. There is no protection mechanism offered, except for the promise that the funds committed will be returned to the investors should the team fail to deliver the scheduled results as per the roadmap.

- Neither the code, nor a Minimally Viable Product have been revealed so far. The founders refrain from any public comments on the project as such, or the pre-ICO and the ICO. The available whitepapers have not been authorized by them either.

- The funds raised during the pre-ICO will be used to finance the deployment of TON project, as well as to cover the costs of its governance structures (the TON Foundation and the TON Reserve). The founders do not specify further how the money raised will be used, nor offer a cost breakdown beyond some summary budget figures based on the data from Telegram messenger. Without such details it is difficult to assess whether the amount raised will be enough to achieve the project’s main goals.

- Political risk: Telegram also stands out by virtue of political/country risks it potentially faces. Because the project is firmly committed to the values of decentralization and anonymity, it may disturb governments across the world who may ban its use in their jurisdictions. This, in turn, may cause a decrease of the users’ base, on which Telegram depends if it is to reach the stated goal of achieving mass adoption.

Useful Links

TON’s preliminary public whitepaper:

http://zefir.site/wp-content/uploads/2018/01/TON.pdf

TON’s technical whitepaper: http://zefir.site/wp-content/uploads/2017/12/ton-tech.pdf

Information about Telegram: https://en.wikipedia.org/wiki/Telegram_(messaging_service) and https://telegram.org/faq