Distributed Credit Chain - unique platform for solving banking problems and tasks.

Today, probably everyone who spends at least some of their time surfing the Internet and following the emergence and development of new technologies has already heard about the technology of a distributed register, a single-ranked network of transactions or simply a blockchain, how it came to our world and what are the consequences of the massive use of it is almost all online industries, we have today. Undoubtedly, many people who are not even experts in this field, after a little reading about how everything is arranged, can understand what benefits this technology has in itself and determine for itself and the surrounding world both short-term and long-term prospects for further mass adoption and development of this miracle of computer thought.

And in this post I would like to give another example of how this technology and people who build their projects on it try to "decentralize the non-centralized", namely, the banking and credit sector of the economy, a very complex, problematic and hidden from the eyes of ordinary members of society and almost monopolized by several large financial organizations sector of the world economy.

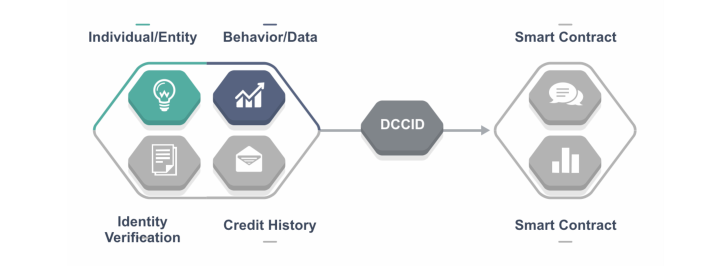

DCC team positions itself as the world's first public, distributed, banking detachment designed to create a decentralized ecosystem for financial service providers around the world, expanding the powers of the parties involved through the use of blockchain technology, which leads to the loss of the relevance of participation in the provision of financial services third parties and various kinds of intermediaries, as well as implementing reliable protection of credit data and guaranteeing the owners of such data unilateral and technically safe in fondling them.

The main mission of DCC is to provide the world with an opportunity to create an honest and transparent ecosystem where interaction between the parties will take place in a completely new and beneficial for the parties key, as well as solve a number of inherent problems in this sector of the economy such as: the excessive cost of this type of services and overstated interest rates on loans, efficiency and efficiency of service delivery, market speculation by centralized monopolists, etc. and also to enable various types of regulators to monitor the data on this industry, recorded on the blockchain, without any possibility of their distortion, substitution or removal, which will allow them in time and effectively organize the risk management and prevent illegal actions by unscrupulous lenders and borrowers.

It is also important to emphasize that with the help of DCC, users can now compare their requests and opportunities with various financial institutions that are ready to provide funds for a loan and choose the borrower in accordance with the most favorable terms, regardless of location, time zone, legal or other barriers which exist at the moment in the sphere of lending to individuals and businesses.

For today, we can see that the project has its own blockchain and beta version of the DCC Open Platform platform, which serves as a centralized marketplace for data and financial services, through which the parties themselves can actually interact to achieve some consensus on transactions. By the way, the test network of the project's blockchain system was launched as early as October 2017. The project has also completed its token with great success and the DCC token has already been traded on such exchanges as Bibox, KuCoin, Idex, Fcoin and DExtop, current capitalization information and the volumes of trades can be observed on the coinmarketcap.

At this stage, the team is developing API platform, "conquering" the financial services market in Indonesia and concluding partnerships with global financial institutions and projects, which we can observe in your social networks and media channels. Also in the plans for 2019-2020 "intrusion and consolidation of positions" in the markets of Vietnam and South-East Asia, which can have a very positive impact on the development of the DCC ecosystem and attract a huge number of platform users.

ICO.

Ticker Token: DCC.

Type of the token: ERC20 with further migration to own locker.

Price of the token on the ICO: 1 DCC 0.0388 USD (0.00007299 ETH).

The purpose of raising funds for the ICO: 49,000,000 USD in the equivalent of ETH.

Previously, it was sold on the pre-sale: 26,400,000 USD (with a bonus of 80-100% in USD).

Total number of tokens: 10,000,000,000 DCC.

Number of tokens in circulation at the moment: 973,098,288 DCC.

Total was available for sale to investors (tokens sold): 22%

Accepted currency: ETH.

Whitelist KYC: yes/yes.

• Website - http://dcc.finance

• Whitepaper - http://dcc.finance/file/DCCwhitepaper.pdf

• Facebook - https://www.facebook.com/DccOfficial2018/

• Twitter - https://twitter.com/DccOfficial2018/

• Telegram - https://t.me/DccOfficial

My Telegram - @Pablobull

My Bitcointalk - https://bitcointalk.org/index.php?action=profile;u=854571