MoneyToken - blockchain-based financial ecosystem.

Hello!

Today, cryptocurrencies are becoming more popular and in demand. But while the payment for goods and services by digital currency is not a profitable and daily operation. Cryptocurrencies are now mainly used as an investment tool. They can also become a lucrative asset for secured lending. The use of digital currencies as collateral is beneficial to borrowers in the event that the value of the cryptocurrency will rise faster than the amount of the interest rate on the loan. Participants in the lending market are interested in having a platform with which to use this particular situation. The platform will be especially attractive for large holders of cryptocurrencies, for example, miners, teams that received funds through ICO, traders and sites carrying out transactions with digital money. The community needs a site that, on the one hand, would allow preserving the cryptocurrency, and on the other hand it would close the need for obtaining stable settlement funds and allow the use of liquidity of crypto active assets. Such a platform will be MoneyToken https://moneytoken.com/.

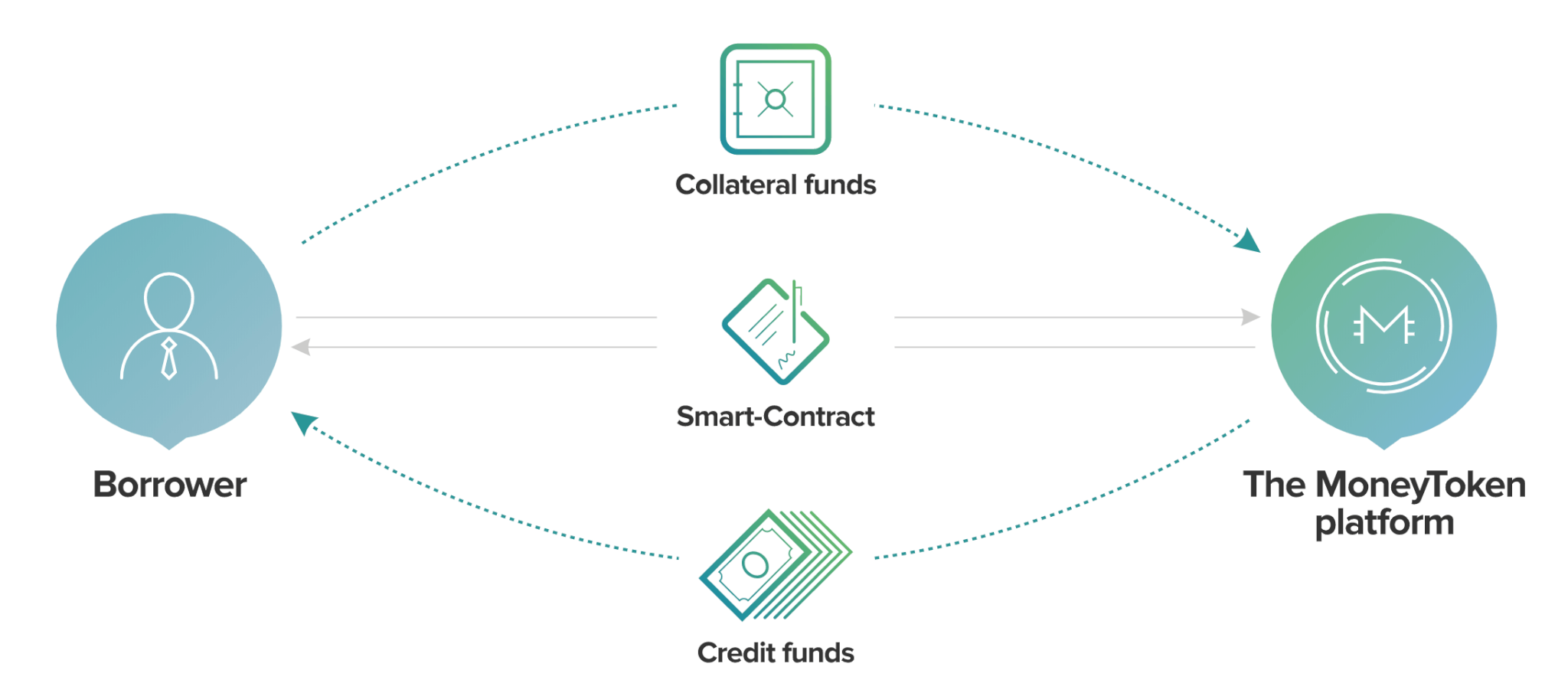

Existing cryptocurrency assets can be divided in two directions. Volatile assets are investment, and more stable cryptocurrencies - to payment means. The traditional banking system at the moment does not allow you to get the currency of the loan on credit secured by crypto assets. Also holders of digital money can not pass the system of assessing the solvency of customers to obtain a loan from the bank. It is necessary to address these issues. This is what the MoneyToken project team is engaged in. Transactions on the platform will be secured through the conclusion of smart contracts. And this will exclude the intermediaries that are necessary for the traditional loan in the bank, for example, lawyers, agents for scoring, etc.

Now I will tell you about the credit model offered by MoneyToken. After choosing the terms of lending and deposit of collateral, the loan is automatically confirmed. All this is done within a few minutes. There is no need for long waiting, passing the verification of the accuracy and relevance of the borrower's data, as well as assessing solvency. After confirming the loan, the client receives a fi nancial cash or a stable currency.

It will be attractive for borrowers to manage the terms of the loan themselves. Users will have the option of full or partial early repayment of the loan. On the other hand, the term of using credit funds can be extended by making an additional deposit. Also, customers will be interested in the opportunity to deposit collateral in several cryptocurrencies. This will help maintain the stability of the overall volatility of the collateral, and also reduce the collateral load on the borrower. Blockchain and smart contracts will ensure the transparency of the entire lending process. Review and control of operations for obtaining and storing a loan, evaluation, changing conditions will always be available to the parties to the contract.

Comprehensive assistance on the platform MoneyToken will provide a virtual assistant. In this project, the name of the assistant is Amanda. Her work is based on artificial intelligence. So Amanda will help users not only understand the functions and services of the platform, but also offer financial services to MoneyToken, which will exactly interest a particular client. Also, the assistant will always remind you of the terms of the loan repayment, payments execution, and the tracking of the pledge. "Communicate" with such an assistant will be easy and pleasant for everyone.

Now a little about the reliability of the platform. Collateral digital funds in purses will be available only after confirmation of 3 signatures. The address with a multi-signature for each crypto currency will be separate. This approach will eliminate fraud and fraud.

Collateral will be returned to the borrower after the loan has been fully repaid. The platform offers different methods of repayment - the same currency in which the loan was issued, another crypto currency or with the help of collateral. So that each client will be able to use exactly the method that he considers to be the most suitable and profitable at the moment.

Developers MoneyToken released an IMT token. The owners of IMT tokens will benefit from the platform. Markers will give a 60% discount on services and site services. Now the last days of Token Sale are taking place. The cost of 1 IMT is $ 0.005. There will be no more chance to buy markers for such a price and still get 20% as a bonus. Do not miss your chance. Token Sale ends on June 6, 2018.

https://moneytoken.com/

Author Adwarteq

My Bitcointalk https://bitcointalk.org/index.php?action=profile;u=1950016

Myetherwallet 0x2A91b152f2e7C48caaD522Fd523Be04f9EF4c075