Distributed Credit Chain ICO review

There are some situations when we need to borrow money. Usually, we take loans from relatives or friends, who of course do not require interest on repayment. However, if we do not have anyone to turn to, we have to take a loan from a bank. The bank gives money only at interest so we overpay in the end.

If you plunge at the history of money, you can see how bankers (who, honestly, are, in fact, ordinary usurers) showed considerable ingenuity in drawing up mechanisms to multiply their monetary capitals. Their main invention originates in ancient Babylon and is called loan interest. It is worth noting that for the legalization of loan interest in society, usurers had to go through a number of stages. All stages of The Overton window were realized: from a complete rejection of this phenomenon to the legislatively fixed norm, which we see at the moment. Personally, I do not like such a phenomenon as a loan and I myself try not to use it. To my mind a loan should be treated as an operation, I mean if this is a vital necessity, and you cannot do without it, then of course you need to use it. But if you have an opportunity not to take out a loan, then I think you shouldn’t take it out and pay interest. However, now in many countries, for example in the USA, the practice of taking out loans is very spreading. Most Americans regularly use credit cards, even if they have enough money to buy these goods without credit. These are certainly extremes, but there are situations when a loan is needed. For example, when one of your relatives falls ill with a dangerous disease and a big sum of money is required for treatment, or your gas stove is so leaky that neighbors begin to complain about the smell of gas, and you do not have money for a new gas stove at the moment. I can enumerate a lot of examples of such situations, but the main thing is that the need for credit exists.

If you find it necessary to take a loan, you can take it from a bank. But in the traditional financial banking system there are many problems:

- high repo rates of central banks, resulting from which credit is extremely unprofitable

- the human factor plays a significant role in deciding whether to grant you a loan or not

- cause-and-effect relationship of the monopoly of the Central Bank is the slow development of technology, since when there is a monopoly - there is no competition, and there is no competition - there is no desire for development

The project, which I'm going to tell you about in detail below, offers solutions for these problems.

The project Distributed Credit Chain is a platform developed on the blockchain technology for the financial services, and if more specifically for the credit products.

The Distributed Credit Chain project offers the following solutions to the problems of the traditional credit system:

- Reduced loan rates: you do not have to overpay for a loan

- Instant credit processing: you do not have to wait for a long time to approve your application

- International in scope: it does not matter in which country the client lives.

- Elimination of monopoly: thanks to the distributed banking ecosystem, the project seeks to break the monopoly of traditional financial institutions and return the revenues from financial services to all participants in these services

The main goal of this project is to change the system of issuing loans.

One of the main benefits of this project is that the blockchain technology allows saving the credit history of each customer. That’s why it won’t require a lot of time to be checked. Thanks to this fact the loans can be issued instantly without spending a lot of time on this procedure.

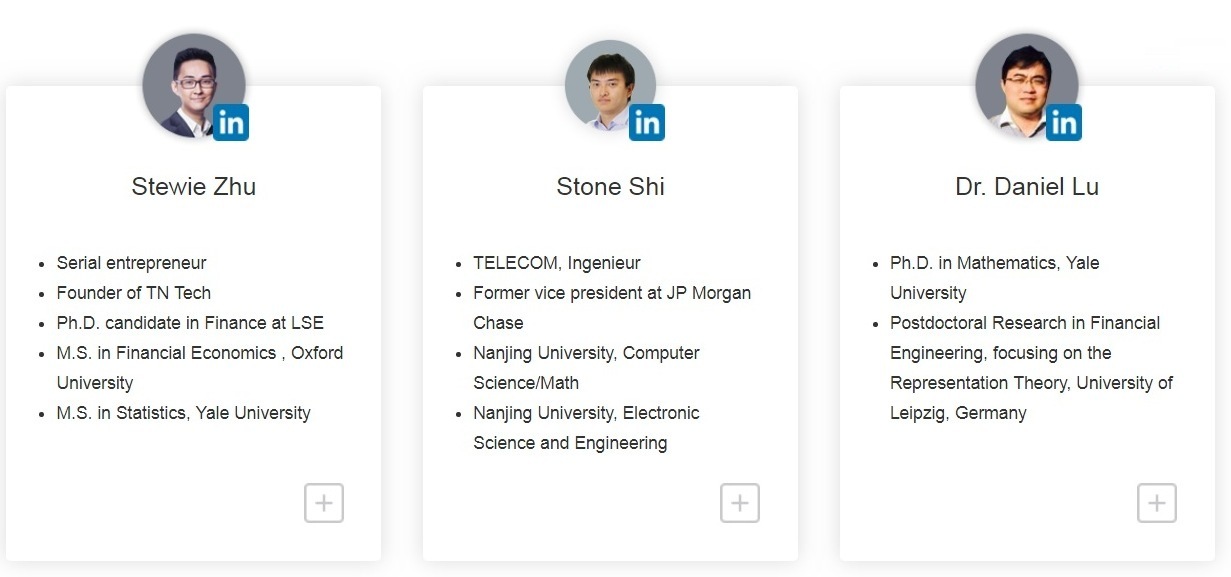

The team

The partners

The conclusion:

The need for such a financial service as a loan certainly exists. And the fact that Distributed Credit Chain has already collected a hard cap, means that a lot of people are interested in this project. People are really fed up with the problems of the traditional financial services system that this project can solve. The blockchain technology is very suitable for improving the financial sector.

Website: https://dcc.finance/

Whitepaper: https://dcc.finance/file/DCCwhitepaper.pdf

Telegram: https://t.me/DccOfficial

Facebook: https://www.facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Author:

https://bitcointalk.org/index.php?action=profile;u=1715139