Governance in distributed organizations, part 4

In previous parts (1, 2, 3) I’ve explored the need for creating distributed decentralized organizations, walked through fundamental internal problems of centralized organizations, and gave a brief overview of existing governance approaches in blockchain projects.

Here, I will outline a suggested system, that I’m working out, that’s designed to keep simplicity and clarity of Dash DAO while (hopefully) answering the challenges.

Outline of suggested system

In previous part I’ve finished by describing the challenges of Dash DAO and difficulties to rapidly experiment with it, because it’s (1) hard-coded in the consensus protocol and (2) is serving a $1bln plus ecosystem.

So, why not combine Dash treasury and governance system with smart contracts? Let’s do it…

Most popular prototyping choice for smart contracts now is the Ethereum network.

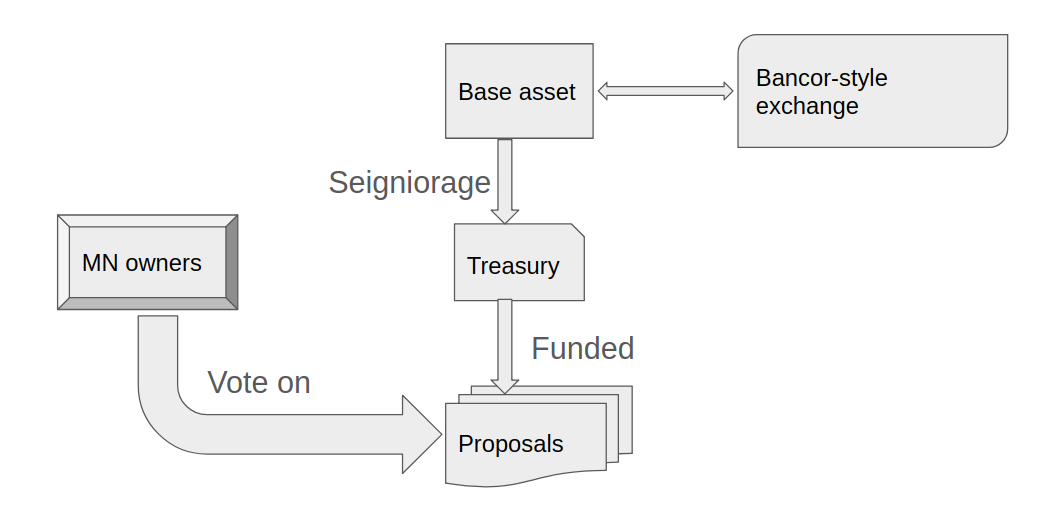

First of all, we need some base asset. Since Dash treasury is build from PoW inflation, we can’t use standard ERC20 token with fixed supply.

Let’s take instead simple PoS token instead, and modify it, so some part of PoS seigniorage would be withheld for the Treasury.

The Treasury would be a separate smart contract, that would store ipfs hash of the proposal, amount requested, proposal funding address, and collect an antispam submission fee.

To reduce populism we can require only people, who hold necessary amount of base token, to participate in voting.

Finally, Bancor-style exchange smart contract would bring liquidity to our base asset.

This way we would mimic Dash governance system on the Ethereum blockchain.

Obvious improvements

By reimplementing it on the Ethereum blockchain, we get much more flexibility, than it is present in Dash. It’s because we can pay to a smart contract, not just an externally owned account.

First of all, it’s easy to replicate TheDAO requirement of the project bond: target smart contract should hold necessary amount of our base token and, in case of failure to complete the project successfully, they would be either burned or sent to Treasury.

Next, we would need some way to determine if the project was successful and on time, or not. For simple projects we can encode those conditions into the project smart contract, but in general it won’t be possible, so we’d have to rely on human judgement, and ask voters to determine if they are satisfied with the result.

To increase voting participation, we can tune holder’s PoS seigniorage profit depending on his participation in voting process.

Also we can experiment with different forms of liquid democracy. Or introduce collateral lockup to increase voting power.

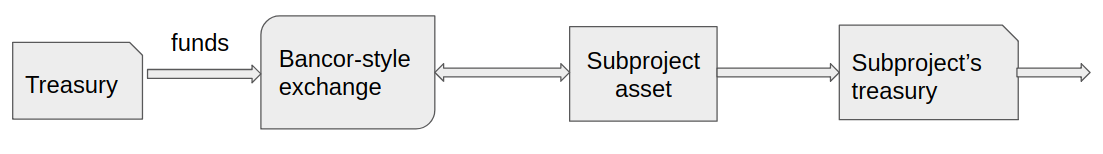

To mitigate the risk of dumping the base asset, Treasury can send them to another Bancor-style smart contract that would pair our base PoS token with the proposal token, introducing early liquidity to the proposed project participants and market feedback via proposal token price.

Finally, the Treasury can find a similar smart contract, thus effectively creating a subDAO focused on a specific goal, e.g. marketing. The subDAO can be long-lived, with it’s own governance structure, and may create more specific subprojects as necessary. Holders of base token aren’t required to deal with minutiae and specifics of the subprojects, while people in the field aren’t required (but still are able) to influence high-level matters.

Summing it up. Using proposed Treasury structure, we can create a flexible on-chain governance system that can be as small or as big as necessary.

Big problems could be attacked by issuing a Business Problem Statements and have several proposals to compete for the success fee in solving them, at the same time. Those proposal can be short- or long-lived, as necessary, and can get market feedback by issuing their own tokens.

Since proposal voting happens on-chain, the governance can be as public or private as necessary, while staying censorship resistant.

Forthcoming Implementation on Ethereum

While various game theoretical aspects of this proposal are still to be explored, I’m going to implement a prototype of this governance system on the Ethereum at https://github.com/akhavr/Recursive. First working version of this governance system would be used in my DevNullAI project.