POOL OF STAKE ICO PROJECT PROOF OF STAKE (PoS) WE WILL LEAD TO PIONEER!

Hello!!!

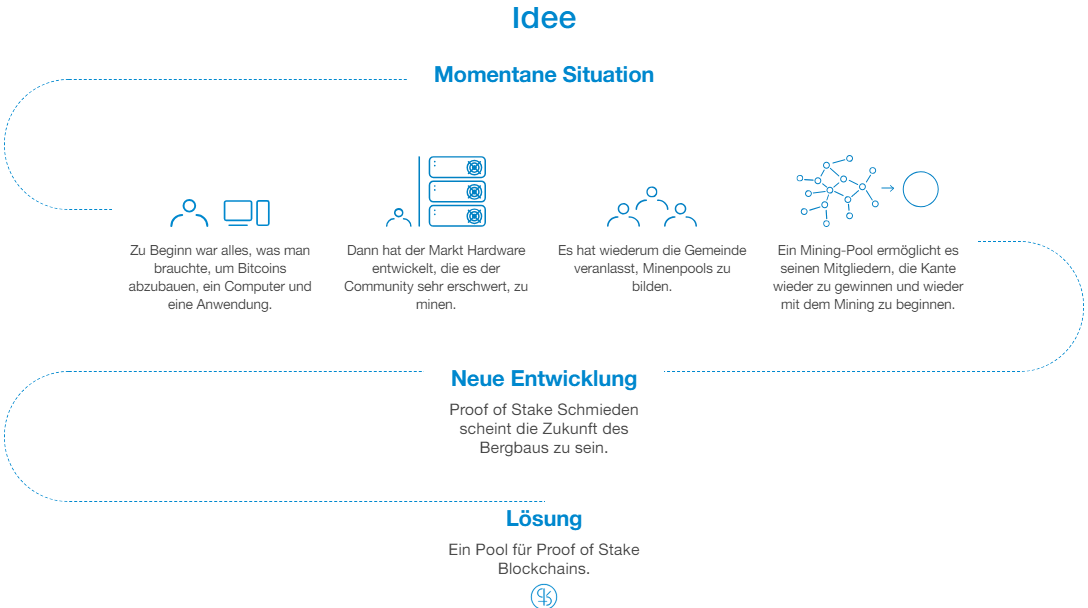

Pool of Stake (PSK) is the first decentralized pool to prove the bet, the future Blockchain. Qtum, BOScoin, Tezos and other PoS coin holders can join Pool of Stake and run Mining 2.0, generating daily bonuses for the forge by simply smashing their PoS coins.

There are several advantages! First of all, the security of the system, the scale of the economy, energy saving, AI in support of the best investments for PSK members is a comparison of the rewards of various block chains based on the real data of the community members and support of the chain-chains that act through a transparent management mechanism.

We have 1 type of IOU for the blocky and 1 IOU, each transaction is generated at the site of your personal wallet, and you are according to the distribution of the daily rewards.

No problems! The payment of the original amount transferred to the site will still be free, but the premium that you create will be reduced in accordance with the table that fixes the fee.

We have connections with several exchanges. At the moment, we can not give names or details due to legal norms. There are several Internet leaks that we can neither confirm nor disprove.

If you are particularly enthusiastic about voter turnout, and you do not agree with the results of voting in the pool, you have a choice. First, you can withdraw your old coins from the PSK site, transfer them to your PoS wallet, and directly participate in your native Blockchain. However, in this case, you lose money without losing your daily rewards.

With a full chain system and an IOU certificate, we can ensure the full safety of your coins.

Every day through a snapshot of tokens on the node every night at 23:59:59 CE (S) T and on the distribution of the reward generated during the day.

PSK is our service token, which is used to reduce the fee for removing the generated premium. IOU is a certificate of possession, which gives you the opportunity to transfer a token from a forging unit.

You have 2 options for buying PSK through ICO or stock exchanges.

The PSK team can not move your personal tokens! Only you can load and unload markers using the token mechanism. Therefore, it is important that you pay close attention to the wallet, on which you receive tokens with IOU.

Our analysis showed that most PSK users will have different PoS coins. There are different voting procedures for each PoS block-chain. PSK will provide a unified voting process that will allow PSK users to vote on different PoS block chains through the same mechanism. In addition, in most cases, voters should have a minimum number of coins for voting. Since members of the PSK have their coins put into the pool, they can simply use the PSK dialing mechanism to influence the development of the native PoS block chain, without removing their installed coins. Thus, the PSK management model allows simultaneous voting and participation in the pool. In addition, it facilitates electoral processes for the electorate of PSV.

No, only you can do this, the IOU mechanism gives you full responsibility for this process.

The intelligent algorithm will help the user to orient all members of the community to provide a high level of confidentiality, giving some idea of the quality of the investment and that some tokens are more profitable.

No, we are not an exchanger, you need to buy in the market, and then move your coin to the PSK node.

A proportional split between 0% and 10% based on the PSK stored in your personal wallet. The PSK system analyzes the number of PSK tokens held every night, and calculates the reward. PSK does not need to spend, they just need to keep.

Nothing! You can continue to use the PSK service and free to withdraw your original PoS coins. If you want to withdraw the generated bonus, the PSK team will be charged a fee of 10% to ensure future development.

Distribution occurs 10 days after the closure of the ICO.

Nothing! You miss the chance to influence the development of the block chain PoS according to your interests. For dPoS coins, you have the opportunity to transfer your voice to a PSK delegate who acts on behalf of your and other voters' interests.

Proof-of-Work: A method that requires the miners to test transactions in a block chain by developing a mathematical function called a hash.

Proof of collateral: a method that allows miners to check blocking transactions based on the number of coins they use on this network (as deposits). Here is a message in which the founder of Ethereum explained the philosophy of PoS design.

Both methods exist to fulfill the overall goal of Blockchain: To confirm that the person sending bitcoin (or any digital currency) has the correct amount of money on his account. And after the transaction is completed, he or she no longer has a coin on his account (otherwise, to avoid duplication of expenses).

Yet these two have a different approach to this goal. PoW versus PoS: buying a shovel or deposit in a bank.

By definition, proof of work means violation of the hash function and proof of the correctness of the result. While it's hard to decode this function, it's easy for other miners to check the result as soon as the miner gets it - just returning it to work to see if it works as an algebraic problem, If yes, congratulations! Here's the price. So take your shovel, do the physical work and show everyone that you have extracted gold.

Nevertheless, evidence is a mechanism that does not require mathematics. Instead, simply block a certain amount of your bet on the network, ie, your crypto currency generated in this chain. This is your proof, because something is at stake. The network uses a random selection algorithm to determine who the next blocker is, with factors such as the number of coins you lock, how many years the coin is or how long you have been imprisoned, etc. Different block circuits based on PoS have different criteria, but this Core does not require a lot of hardware work. This is something of a retention and interest.

PoW versus PoS: Reward for the block against the bonus block.

In the block-chain based on PoW, miners perform hard work and receive compensation. Remember Bitcoin and Etherium, where the new unit awards 12.5 bitokoyanov and 5 ethers. But there is one more thing, the transaction fee. If you send me bitcoy, this transaction should be checked and documented in the block chain with the help of mathematical mathematics, which makes miners. But they do not do it for free, so you need to attach a commission for the transaction. The next lucky guy making the next block gets all the transaction fees and the reward itself for the block, which is 12.5+ bitcoins.

In the PoS method, the block chain has no reward for the block. Only transactional fees. Therefore, participants in the PoS flowchart should also be called validators, not miners. They only facilitate the verification of transactions without participation in mining activities, such as PoW.

financially:

PSK character

Bonus is available

Available Bounty

MVP / Prototype available

Ether

Accept ETH

Minimum investment 0.1 ETH

Soft cover 2 million euros

Hard cover 8 million euros

Country Switzerland

White list / KYC

Limited areas of the United States, China, Canada, Israel, South Korea, Vietnam.

schedule:

06/02/2012: White paper and business plan.

03.2018: Formation of the company.

03/23/2018: press release.

07/20/2018: Start ico.

08/19/2018: the end of ico.

Q3-2018: Platform release.

Q4-2018: Platform release (dPOS).

Are ICOs better than venture capital?

There is still a conservative wave of thinking that reluctantly accepts ICO as venture capitalists (VC) as the main source of new business acquisition. These conservative thinkers argue that numerous factors, especially volatility, cause too much uncertainty over traditional VC financing. In The Pool of Stake, we believe that these conservative thinkers are wrong and that ICO is the beginning of a financial revolution that gives developers and investors more freedom. In the next article, we compare the growth for each of these fund-raising methods, and then explain some of the advantages of getting cash from ICOs, rather than VC.

The beginning of this decade has become a rapidly evolving phase for the collection of VC funds. Thousands of start-ups received millions in exchange for justice and the right to vote. This led to the creation of several remarkable companies, but it also paved the way for many companies with excess financing that did not achieve what they planned. After a certain peak, VC funds showed signs of withdrawal. There are two variables that we can use to measure the state of VC funding. The first is the total number of VC transactions that took place around the world, and the second is the total financing of VC in dollars. The high point for the total number of VC financing transactions was the first quarter of 2015. The peak cost for total VC financing in dollars was in the second quarter of 2016. According to one https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2017/07/venture-pulse-report-q2-2017.pdf

we compare the peaks with the last checked numbers.

Q1 2015 - Higher total funding for VC: 5,250

Q2 2017 - Recently updated data on VC financing transactions: 2,985

Change = -43%

Q2 2016 - Peak for VC total financing in dollars: just over $ 45 billion

Q2 2017 - Latest data on total VC funding in dollars: $ 40 billion

Change = -11%

The trend is obvious. The total number of VC financing transactions decreased, as well as the total VC financing in dollars. What does this say? VCs have ceased to be so generous with their funding and are more selective about their projects. A lower decline in total VC funding in dollars, accompanied by a large decrease in the total number of VC financing contracts, supports this theory. Financing VC also has shortcomings for investors and the project team. Investors work for a share capital, which they can not sell on the open market if they want to unsubscribe. Project teams are limited to investors who have an active management role in the company, which requires that projects are already implemented,

ICOs draw another picture. Last year was the first boom for the market, and this year looks even better. According to

https://www.coindesk.com/6-3-billion-2018-ico-funding-already-outpaced-2017/

$ 6.3 billion. The United States, achieved so far this year

https://www.coindesk.com/6-3-billion-2018-ico-funding-already-outpaced-2017/

constitute 118% of the total invested in 2017, which was the peak year. Since we have not finished the second quarter of this year, we will compare the first quarter of 2018 with the same quarter of 2017, which was the peak year for ICOs (the first quarter of 2018 is the highest in the history). We use coefficients similar to the VC coefficients, taking into account the total number of ICOs that received funding and the total US dollar spent. The data looks like this:

Q1 2017 - Total number of MHIs receiving funding: 15

Q1 2018 - Total number of MHI receiving funds: 203

Change = + 1.353%

Q1 2017 - A total of $ 38,740,000 collected by ICO

Q1 2018 - The total amount of the US dollar received by ICO = 6,330,150,000 US dollars

Change = 16.340%

The numbers speak for themselves. Increased interest in ICO. Despite the uncertainty caused by volatility and regulation this year, investors and projects are still jumping into ICOs. Why? Because they offer great advantages, which are not in other forms of fund-raising. One of the key advantages for investors is that they do not focus on the illiquidity of the company's shares, which they can not sell, as it does with venture capitalists. After the IPO, the project's token can be freely sold. If the investor is not completely convinced of the development of the project, he can sell his share or buy more if he likes it! From the point of view of the project team there are many advantages. First of all, it's easy to collect money from investors around the world, so it's very easy to collect a budget for project development. Secondly, the company should not provide shareholders with shares or voting rights so that they can manage their project as a captain at any time. This is very important, because venture capitalists sometimes run into projects and either deny the idea or do not allow positive changes due to excessive attention to profitability. This is especially important, as almost every major company in the world has changed and changed its business model. so they can always lead their project as a captain. This is very important, because venture capitalists sometimes run into projects and either deny the idea or do not allow positive changes due to excessive attention to profitability. This is especially important, as almost every major company in the world has changed and changed its business model. so they can always lead their project as a captain. This is very important, because venture capitalists sometimes run into projects and either deny the idea or do not allow positive changes due to excessive attention to profitability. This is especially important, as almost every major company in the world has changed and changed its business model.

Pool of Stake takes pride in this new method of fundraising. We look forward to achieving our financing objectives with the ICO. We also want to help people who helped implement the project. We do not give away any securities or shares of our company, but rather a sign that improves our product and provides real value to all who apply it.

For more information, please click on the link below:

Website: https://www.poolofstake.io/

Twitter: https://twitter.com/poolofstake

White paper: https://www.poolofstake.io/wp-content/uploads/2018/04/Pool_of_Stake_whitepaper.pdf

Telegram: https://web.telegram.org/#/im?p=@poolofstake

Facebook account: https://www.facebook.com/poolofstake

YouTube channel: https://www.youtube.com/channel/UCenEbx5MwCF7kjTAWU-jv_g?

Author: https://bitcointalk.org/index.php?action=profile;u=1230839