ASSETSTREAM - consider your abilities and preferences

At present there are a large number of problems related to microcredit. This is a great opportunity to create your own business, to get the required amount with favorable terms. But unfortunately, the lack of proper operation of a centralized organization, as well as problems with fraudulent schemes, do not allow working normally. Developers of the decentralized platform, AssetStream, are confident that they can use the blockchain advantage to create unique projects. Unique ecosystems with conditions that will benefit investors, as well as people who need loans.

What is AssetStream?

AssetStream is a Peer-to-Peer microfinance platform that utilizes Blockchain as a possible core technology. AssetStream aims to be the perfect market for the P2P Lending Platform where borrowers and lenders will have enough information to carry out transactions anywhere and however in a safe and transparent manner.

MISSION

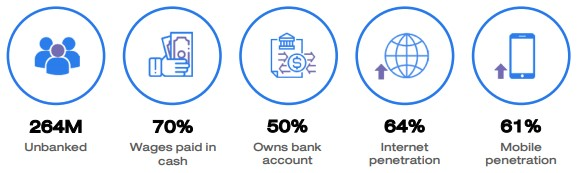

AssetStream aims to reduce poverty and bring financial inclusion by providing people who do not have bank accounts with access to financial services. AssetStream will expand to a full P2P network that will include local communities who can take private loans. AssetStream aims to create a broad microfinance ecosystem that will be able to bring people who are excluded financially to the blockchain through a new global economy.

Problem that can be solved

The creators of AssetStream believe that their decentralized platform is the best solution for modern financial reality. This platform allows you to carry out any operations related to microcredit. The main problem facing people today is worth considering:

Lack of security guarantees. User data is not confidential;

Centralized services often take commissions too high, why pay for intermediary services, if you can work directly

Problem that can be solved

The creators of AssetStream believe that their decentralized platform is the best solution for modern financial reality. This platform allows you to carry out any operations related to microcredit. The main problem facing people today is worth considering:

Lack of security guarantees. User data is not confidential;

Centralized services often take commissions too high, why pay for intermediary services, if you can work directly

TOKEN DISTRIBUTION

ICO (64%) - All proceeds from ICO sales will be stored as reserves on the AssetStream platform and will be included as lubricants for loan collections for the Thai market.

The total budget collected from the ICO will set the maximum loan capacity of the platform to ensure that all tokens can be lent at the same time.

At the same time, the ICO results will maintain the AssetStream Token (AST) value to 0.01 USD and double as collateral to lenders to return money to lenders if the platform does not provide any features that AssetStream has done. Team

Management and Advisory (15%) - Tokens will be committed to recruiting, retaining and training staff to compete with the global market. This token will also be used to promote long-term alignment with advisors and to support other operational costs. This token will be locked for 1 year.

Marketing and PR (8%) - These tokens will be used to increase adoption and attract lenders and borrowers in new and existing markets.

SOLUTION

By offering a bankless population and regulated underbanked alternatives. AssetStream will not only provide borrowers with better loan conditions and protection, the platform will also be able to provide stable monthly returns to creditors.

With our platform, we can provide lenders and borrowers legal protection from local laws and regulations. If NPL we can take legal action to force payment.

By using stable tokens on the platform, we can ensure that the value of the amount borrowed will not be affected by external sources.

By utilizing the Stellar blockchain, this platform can make transactions faster and cheaper than other technologies.

LENDER PERSPECTIVE

A large number of companies that need loans - you can find the most profitable partners for cooperation;

The community is governed by its members, there are no hidden manipulations, complicated combinations or fraudulent schemes;

Monthly refund. This is guaranteed by the project creator - they are sure that they will be able to provide timely payments to all creditors.

Borrower :

No need to pay commissions to intermediaries, you can find the best deals, taking into account your own abilities and preferences;

It is possible to choose loan terms - here you make the application, showing your own conditions. Term, interest - there may be someone whose condition seems favorable and you will be able to work together.

ICO DETAILS

Tokens created: 3,300,000,000 Tokens

Tokens issued: 2,100,000,000 Tokens

Hard stamp: 21,000,000 USD

Soft cap: 1,440,000 USD

Currency received: BTC / BCH / ETH

1 AST = 0.01 USD

Sales Token: 05/27/2019

Exchange list: 07-10/2019

ASSETSTREAM TEAM

To find more relevant details please follow several sources for the following references:

WEB SITE: https://www.assetstream.co/

WHITEPAPER: https://www.assetstream.co/AssetStream-Whitepaper.pdf

FACEBOOK: https://www.facebook.com/AssetStream/

TWITTER: https://twitter.com/AssetStream

TELEGRAM: https://t.me/AssetStreamBlockchain

Author : Berita Anyar

Profile : https://bitcointalk.org/index.php?action=profile;u=1150447