eCoinomic(CNC)-Blockchain System for Financial Service Platform

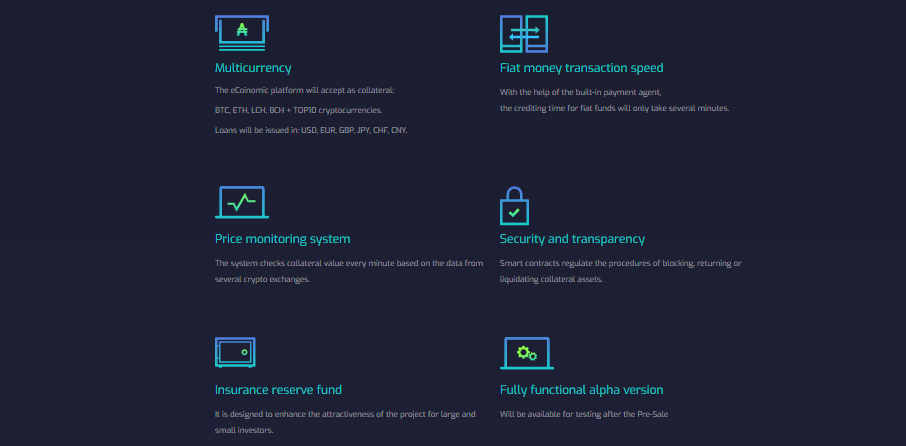

eCoinomic is a new platform providing financial services to crypto holders by way of: investment and asset management, exchange, transfers and mutual settlements between users and partner projects. The Block chain technology possesses a lot of benefits and demerits making it widely controversial. Firstly, the block change technology empowers the users to be in complete control of their transactions. This makes them the customers responsible and engenders trust for all users. This also helps to eliminate counterparty risks associated with the use of a third party oversight. Also, the block chain ensures transparency for customers and auditors alike. This is because it can be seen by all parties involved and transactions cannot be altered. Also because the transaction history is locked into each block, auditors have a simpler and easier time in understanding the movement of the resources. This improves the general outlook of the block chain as being efficient and productive.

Have you known that Blockchain enables financial service platform? This is about it. The new system aims to provide its users with the best opportunities for fiat investment, financial services and transfers. eCoinomic is planning to develop the following set of platform services: Secured and unsecured loans based on fiat money and cryptocurrencies. Long-term and short-term investments in fiat money and cryptocurrencies. Mechanism of hedging the exchange rate risks for crypto assets financialСrypto economy remains very interesting and somewhat mysterious to us. When thinking of this new trend, our consciousness often falls into dissonance, but still, we try to understand it desperately. Thus, we return to basic questions like how, why, and what will happen next. The genesis of Blockchain technology has presented a challenge for all of us.

It is no wonder why we lack experience with cryptocurrencies. Here are four major reasons

Major external influence results in cryptocurrency falls and rises giving high volatility of the crypto assets

- There is no true understanding of how to deal with new technology because it is all new — everything happens for the first time

- Vast majority of people doesn’t understand the basics of blockchain technology behind the coins

- Cryptocurrency trading seems almost like gambling because of little trading experience.

Reasons for cryptocurrency price growth

There are two major reasons for cryptocurrency growth.

- On the one hand, it happens due to the constantly increasing number of cryptocurrency users.

- On the other hand, currency speculation directly influences current market prices, which can lead to a bubble burst.

Now Its ICO Time

ICO is a new way to introduce tokens, the price of which will be established by the request of the coin initiating team. It is initially set up during the ICO and can be changed later after the listing at the exchanges where price will be regulated by the market. Token represents project value that can be different: income, possession of the property, receipt of goods or services or a symbol of the project’s gratitude for the funding received, without any obligations coming from the project. In case if the token is being meaningful, there is a chance for people to start using it and the token price will go up. Tokens draw more and more attention with the increasing number of crypto holders including speculators who do not care about the functionality, but the profitability. In this context, speculators are cryptocurrency investors and traders who tend to jump off the train at the first signal of danger, selling depreciating tokens. Users and speculators are the two main factors that affect the price of the cryptocurrency. In most cases, they influence the volatility of the course and the level of crucial support. Even the strongest cryptocurrencies have insane volatility, which clearly demonstrates that none of them have an overwhelming number of loyal users. It happens because pure speculation is always able to jeopardize the confidence of conservative investors.

User’s expansion results in the growth of capitalization of the cryptocurrency. Thus, its volatility decreases as well as speculators interest, which often indicates that particular crypto assets become mature. From an investor’s point of view, it is the end of a highly profitable investment instrument. However, rapidly growing number of projects shows that there will be more and more cryptocurrencies to gain profits from.Too often over the past time, mainstream media would rush to call for “crash” each time when the price of bitcoin even slightly sank. A day or two was required for bitcoin to regain its losses given its volatility. Considering the cumulative market fall, it is more like a genuine crash.

Lending backed by crypto assets

This is the most popular and apprehensible service to date on the cryptocurrency market. Loans backed by crypto assets present a unique opportunity for their owners:

To use fiat money for business expansion e.g. renew miner hardware

To hedge the exchange rate risk and thereby reduce the exposure to market volatility

To take prompt advantage of crypto assets potentia

The valuation of the collateral can vary from 50 to 70% depending on the type of asset, user rating and application of the loyalty program. The minimal loan amount is 200 USD, the maximum loan amount is 10 000 USD. The loan term is 1 month. In the 4th quarter of 2018 upon the launch of the platform the service fee for issuing a loan will be.

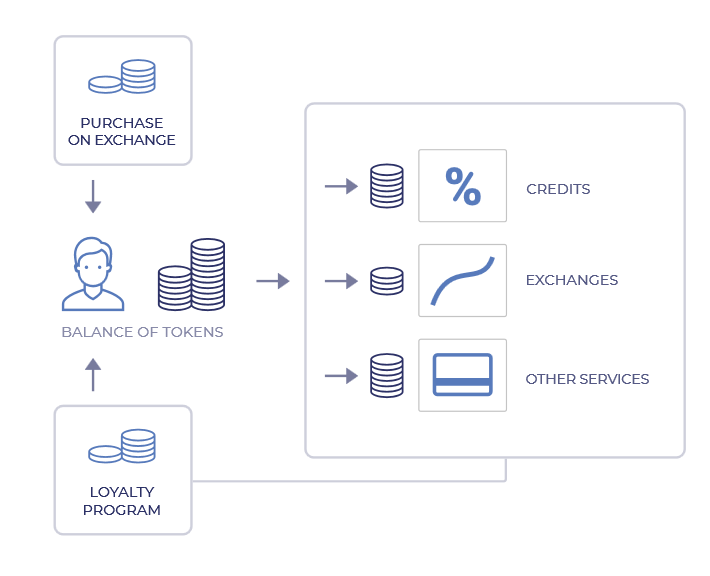

eCoinomic Token (CNC)

eCoinomic is the perfect solution:

1.For crypto owners:

Who purchased cryptocurrency as average and long-term investment expecting a high growth rate; Who received crypto assets as payment for goods and services (e.g. miners); Startups and funds who are in need of short-term fiat credits.

2.For investors:

Private sector investors who allocate monetary resources for the purpose of generating income; Institutional investors who are interested in high profitability and low risk instruments.

eCoinomic smart contracts enforce the fulfillment of loan obligations and thereby protect the investments for the owners of both collateralized crypto assets and fiat funds.

The blockchain is an immutable public ledger that records digital transactions. This technology was first introduced by an anonymous individual under the pseudonym Satoshi Nakamoto in 2008 and has since revolutionized the way we conduct currency transactions worldwide. Blockchain enables trust to be distributed throughout a network, without the need for a central authority to track, verify and approve the digital exchange of value. It operates as a decentralized distributed database, maintaining a continuously growing list of records divided up into blocks. Legacy will take advantage of this technology to be decentralized and place its trust in its users. The blockchain is a fairly new technology and it is still in active development, improvements are happening continuously, and it has become more efficient and secure than the traditional antiquated systems, which is why banks, government, and other institutions are adopting the technology. Blockchains combine concepts of peer-to-peer networks, asymmetric cryptography, decentralized computing and smart contracts into a new technology platform. In short, blockchains are distributed peer-to-peer systems which implement a trustless shared public append-only transaction ledger.

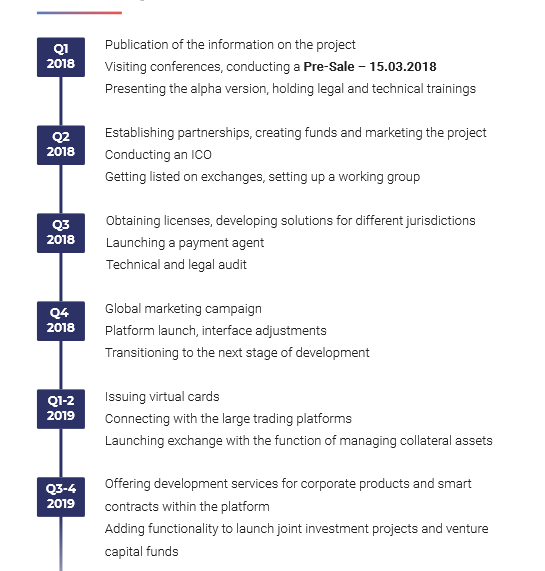

Roadmap

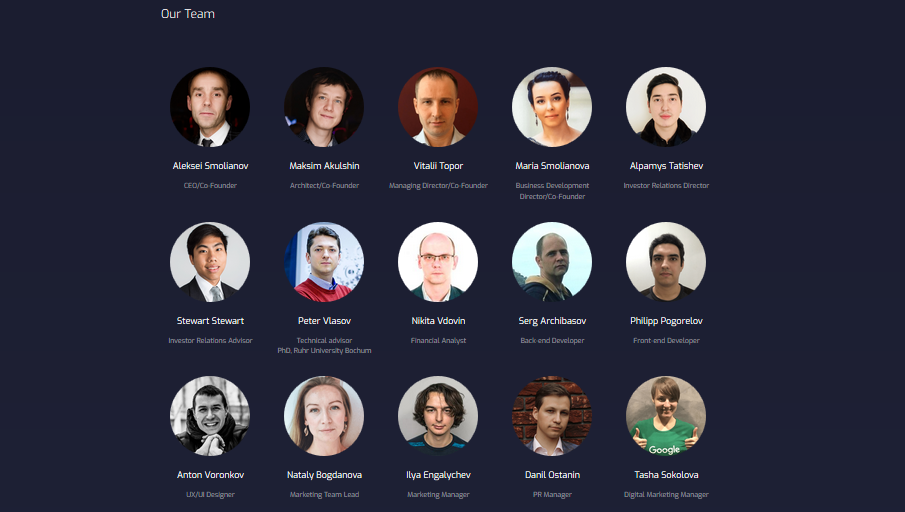

TEAM

WEB: https://ecoinomic.net/

WHITEPAPER: https://ecoinomic.net/docs/WP

TELEGRAM: https://t.me/joinchat/AAAAAEr4kO0ZRm92LNGwLA

TWITTER: https://twitter.com/Ecoinomicnet

FACEBOOK: https://www.facebook.com/ecoinomic/

AUTOR: https://bitcointalk.org/index.php?action=profile;u=1929962