L-Pesa Kripton. ICO.

Microfinance has a long history around the world and for centuries has filled an important need. In fact, various forms of microfinance had a major impact on economic development in Western Europe in the 18th and 19th centuries. In the past 50 years, microfinance has started making an impact in Asia and Africa through organizations like Grameen Bank.

However, traditional microfinance has limited reach, and solutions have been targeted towards poor farmers and small business owners. Middle class consumers and business owners in developing countries have an unmet demand for credit, but the current financial infrastructure in these countries does not support credit underwriting. The market today displays a number of problems:

1.Underwriting

2.Lack of Bank Credit

3.Microfinance targets agriculture only

4.Outdated operating models

5.Microfinance targets the poor only

6.Most consumers un-banked

L-Pesa is an organization that has approved its task show in the course of the most recent year and a half and has manufactured propelled innovation, mechanizing generally activities. around 25%. There are four essential market powers assembled for scaling. Among them are Big Data, Artificial Intelligence and Blockchain, elective credit information, portable innovation, biometric personality. Be that as it may, customary microfinance has restricted reach, and the arrangement is focused to poor ranchers and entrepreneurs. The working class purchasers and entrepreneurs in creating nations can not have any significant bearing for credit, but rather the current money related framework in these nations does not bolster guaranteeing credit.

The present commercial center shows various issues including:

1.Underwrting. Conventional customer and business credit reports utilized for endorsing advances in created nations are for the most part inaccessible, and advances without guaranteeing rights will bring about high misfortune proportions.

2.Lack of bank credit. Customary bank advances are not broadly accessible in creating nation inhabitants.

3.Microfinance just targets horticulture just on conventional microfinance organizations that normally give credits to poor ranchers in rustic territories. Middle class customers try not to approach microfinance

4.Outdated Operating models of banks and in addition microfinance foundations are as of now high overhead costs, battles with absence of information for endorsing advances, and by and large neglect to be taken preferences of new innovation

5.Microfinance is focusing on the poor just to purchasers, agriculturists and entrepreneurs in Indonesia. Creating nations over the most minimal neediness levels have minimal shot of getting credit.

6.Most purchasers are un-kept money. Numerous buyers, agriculturists and entrepreneurs in creating nations don't have ledgers.

The developers also introduced many innovative

processes:

- Big Data, Artificial Intelligence, and Blockchain

Big Data, Artificial Intelligence, and Blockchain New tools allow for storage of vast amounts of data and extensive data analysis at a fraction of the cost from just a few years ago. Advancements in Artificial Intelligence provide new opportunities for automated loan underwriting. Blockchain technology allows for faster, safer, and less expensive exchange of value. Blockchain technology has just started to revolutionize financial services and will lead to enormous efficiencies over the next ten years – blockchain has been described as the internet of money and will do to financial services was the internet did for information and commerce. - Data Alternative Credit

L-Pesa has developed a unique, proprietary credit scoring model based on user behavior combined with traditional and alternative credit data. L-Pesa ompetitors have developed their own proprietary models. Experience over the next decade will lead to revised best practices, which will eventually become industry standards. - Mobile Technology

The rise of the mobile phone over the past two decades has been one of the most profound technological and market shifts in human history. A large majority of humankind now owns a mobile phone, and many own smartphones. Mobile financial services such as M-Pesa have become available in many countries and support both the banked as well as the unbanked population. Based on the market penetration of mobile phones (smartphones and feature phones), mobile money services such as M-Pesa, Tigo Pesa and Paytm have grown very quickly and have enabled L-Pesa. - Biometric Identity

Traditional microfinance has relied on a large network of branches since identity verification has been impossible online and difficult in person.

L-Pesa believes that their token, The L-Pesa Coin, will receive widespread acceptance as it is the only cryptosystem that can simultaneously address a problem in the world. In fact, they have called it "Bitcoin of Africa". They did not need a crystal ball to imagine the time when L-Pesa Coin would be chosen as the African cryptocurrency from Capetown to Cairo.

L-Pesa ICO is proceeding as smoothly and openly as possible and their super heroes are committed to bringing the best results for businesses, investors and developing countries.

Token

L-Pesa Tokens

L-Pesa’s technology stack is built on top of Amazon Web Services, an extremely scalable on-demand cloud computing platform which has been or is used by major brands such as Netflix, Airbnb, Pinterest, and Spotify.

L-Pesa has integrated a number of third party applications to perform tasks such as SMS messaging, user verification, and marketing. Funds transfers are handled via integrations with mobile money service providers such as M-Pesa, Tigo Pesa, and MTN. L-Pesa has issued over 38,000 loans since going live in March 2016. Over 170,000 users have registered based on social marketing campaigns run on a minimal budget. The marketing strategy has been refined over the past 24 months, and L-Pesa is now prepared to launch marketing campaigns via SMS and social media with a conservatively projected customer acquisition cost of $1.00. The founder of L-Pesa, has invested approximately $500,000 to date. The business was launched in Tanzania in 2016 and in Kenya in August 2017. Soft launches are underway in Uganda and India. The company’s technology is stable, scalable, proven, and will support the company’s growth plans. At this point, L-Pesa has hit a growth barrier—there is not enough capital available to lend to everyone interested, and the potential for user acquisition is almost unlimited, but requires capital for marketing expenses and support staff. The company is now raising funds to take advantage of its leading position, strong platform, and nearly unlimited opportunity to extend financial options to a large portion of the earth’s population.

Token Launch Summary

Token name: KRIPTON

Token ticker: LPK

Token owner:

L-P Kripton ltd., Suite 2B, 143 Main Street, Gibraltar

GX111AA.

Company Number: 116865

REID Number: GICO.116865-49

L- Pesa ICO timeline

Pre - sale starting March 10, 2018

Pre-sale ends on April 9, 2018

ICO starts on 10 April 10 2018

ICO expires on 10 June 10 2018

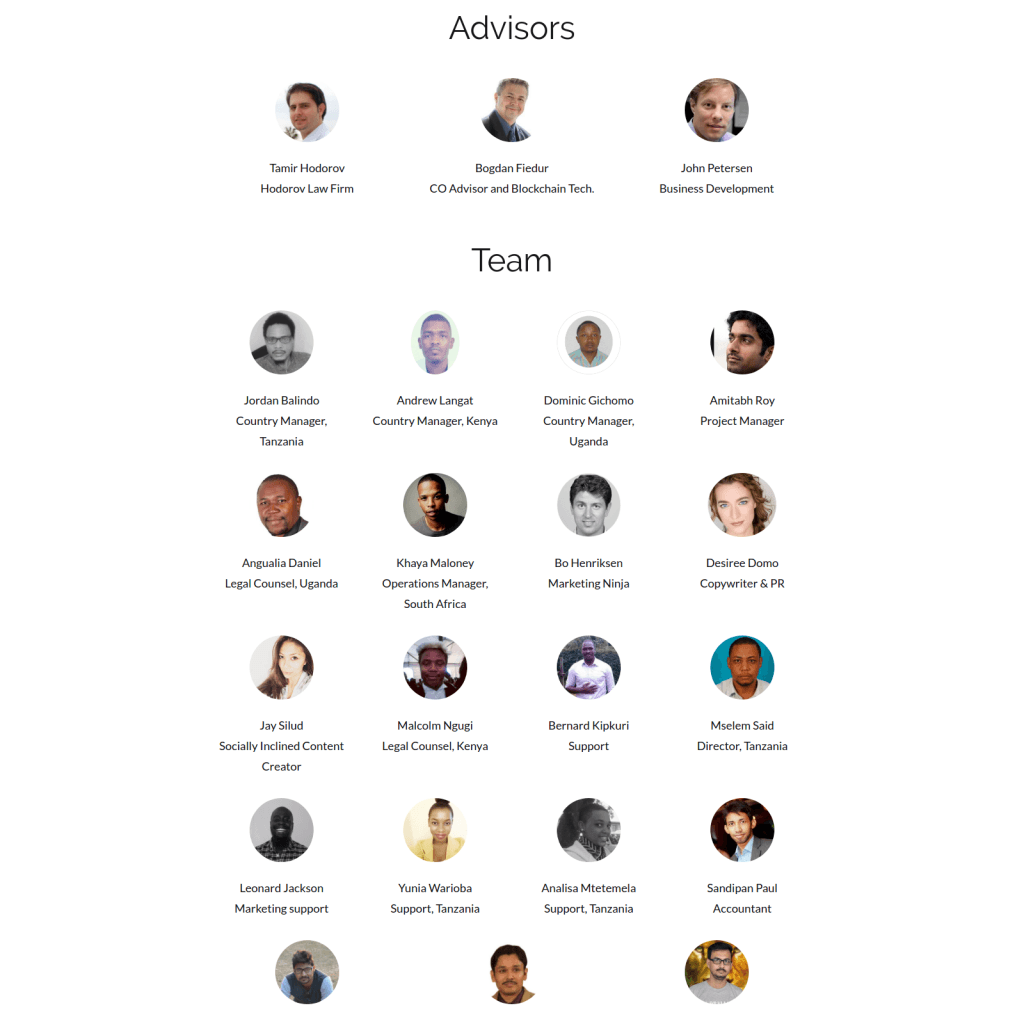

Technology, marketing, and accounting teams operate on a virtual model and consists of experienced staff based in Europe, America, Africa and India.

FOR MORE INFORMATION PLEASE FOLLOW HERE:

Wedsite: https://kriptonofafrica.com/

Whitepaper: https://kriptonofafrica.com/static/pdfs/L-Pesa_ICO_white_paper_Jan_7_2018.pdf

ANN: https://bitcointalk.org/index.php?topic=2873068.0

Facebook: https://www.facebook.com/kriptonlpk/

telegram: https://t.me/joinchat/HbNNkBLQJkw7765Ri7tg7w

Twitter: https://twitter.com/LPesaMicrofin

My Profile Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1929962