Homelend

A MORTGAGE CROWDFUNDING PLATFORM

Today’s Mortgage Lending Industry

Mortgage Loans Are at the Core of Society

Having a home is one of the basic human needs — a need most people are only able to afford by taking out a mortgage loan from the bank. In the U.S. alone, more than 8 million mortgage loans are granted every year.

An Archaic $31 Trillion Industry Yearning for Disruption

The U.S. mortgage market is valued at $14 trillion, and the global market is expected to reach $31 trillion by the end of 2018. Yet, despite how central this market is both socially and economically, the traditional mortgage lending system remains incredibly primitive.

The system relies on lengthy and complex paper-based processes involving various intermediaries — processes that are laden with inefficiencies and overhead costs for both borrowers and lenders. Moreover, mortgage loans are largely unattainable for the new generation of young borrowers, excluding millions of creditworthy individuals from obtaining home loans due to outdated assessment criteria.

Homelend Mortgage Crowdfunding Platform

We Are Developing a Decentralized, Peer-To-Peer Mortgage Lending Platform Serving Two Purposes

Modernizing the age-old mortgage lending system in order to make it efficient, cost-effective and customercentric.

Expanding home ownership opportunities for a new generation of borrowers, meeting their distinct lifestyle and needs.

How does it work?

By leveraging distributed ledger technology (DLT) and smart contracts, Homelend brings together individual borrowers and lenders on an end-to-end platform that streamlines and automates the entire mortgage origination process.

The Homelend Advantage

_Streamlined & Efficien_t

By embedding pre-defined business logic into smart contracts, digitizing documentation and eliminating unnecessarily processes, Homelend will automatically execute an end-to-end origination process, cutting it down from 50 days to less than 20.

Cost-Effective & Middleman-Free

The immutability, security and transparency provided by DLT makes it possible to record transactions, including loans, without banks acting as middlemen. This will reduce costs for both borrowers and lenders, while minimizing the distance between them.

Transparent & User-Friendly

Homelend aims to create a lending process that is not only smart, but also simple and fair. It will enable borrowers will be able to easily apply for a loan, track their application status at all times and interact directly with mortgage lenders.

Trusted & Secure

Centralization and paper-based processes are the key factors behind the insecurity and vulnerability that characterize the traditional mortgage industry. The unique characteristics of DLT and smart contracts enable Homelend to provide a platform for people to transact large amounts of money in a trusted, transparent, and secure way.

The Homelend Token

The HMD token is the fuel powering the Homelend peer-to-peer lending platform. It’s main functionality is to grant access to the Homelend platform.

This utility token also plays an instrumental role in enabling a fast, smooth and user-friendly workflow that is unified and secure.

All tokens can be converted to and from HMD.

Timetable

Pre-Sale…………………..March 1, 2018

Crowdsale……………..TBD

Closure……………………TBD

Specifications

Symbol………………………..HMD

Total Supply…………….250,000,000

Standard……………………ERC-20

Face Value………………..1 ETH= 1,600 HMD

Accepted Currencies…BTC, ETH, USD

Softcap………………………..US$ 5,000,000

Hardcap………………………US$ 30,000,000

Bonuses (ETH/HMD)

Week 1…………………………..20%

Week 2………………………….15%

Week 3…………………………..10%

Week 4 and After…….0%

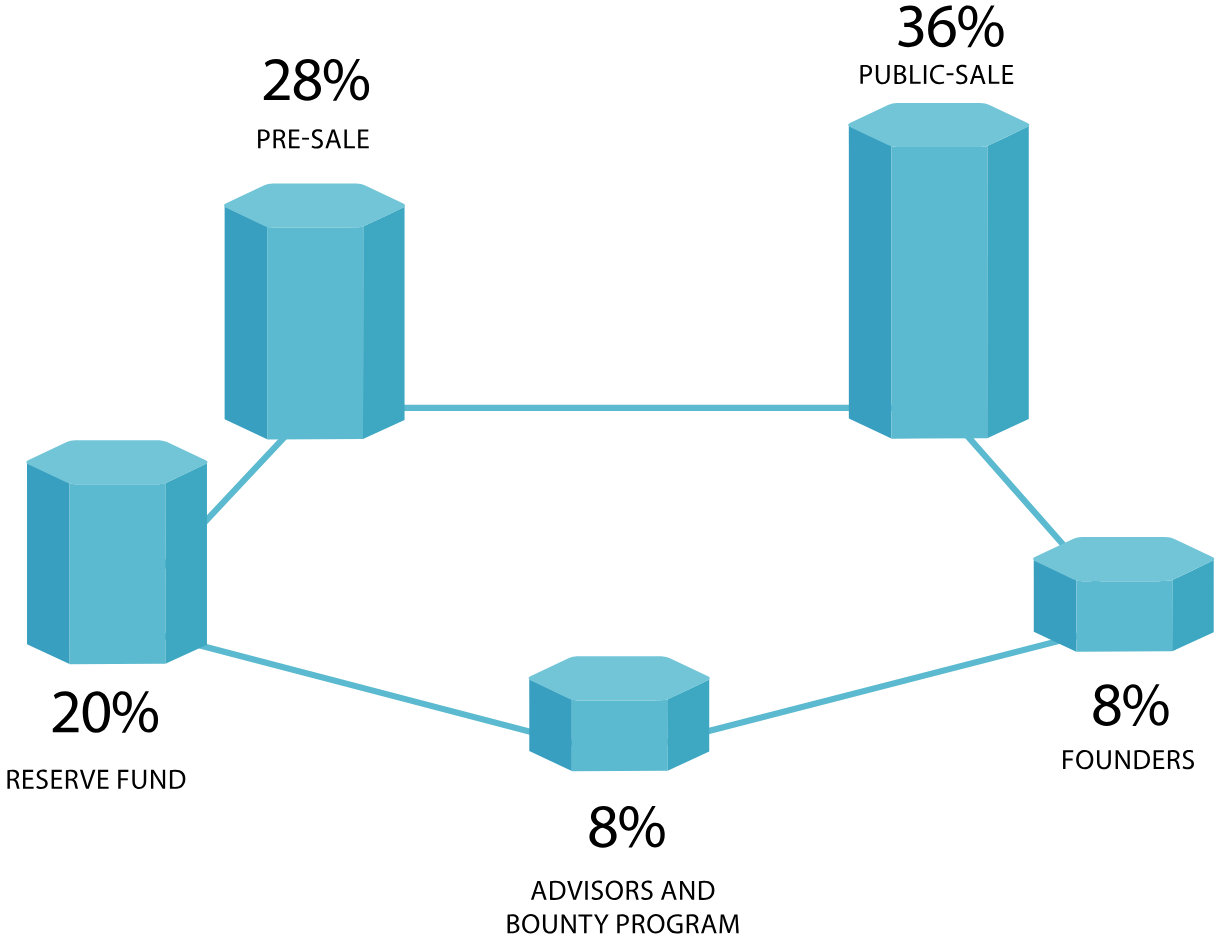

Token Allocation

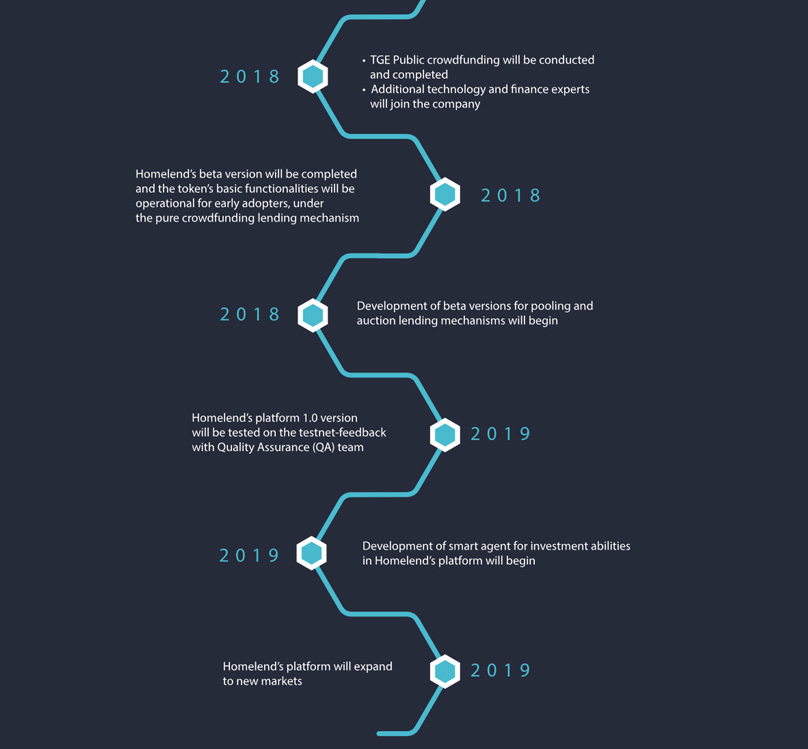

Roadmap

Official Homelend contacts:

WEBSITE | WHITEPAPER | ANN THREAD | TWITTER | FACEBOOK

Author’s BTT profile: https://bitcointalk.org/index.php?action=profile;u=1614962