Distributed Credit Chain review ICO

The weakest point of the traditional financial system is too bloated bureaucracy, centralization and complete control from the state and controlling institutions. Some time ago, bank payments required a long period to get to the recipient, such a financial transaction using paper mail could be delivered after several months. If it happened that because of the negligence of mail workers or force majeure circumstances, the financial documentation was lost on the way to the addressee, Then all actions had to be carried out from the very beginning. The development of technical progress, of course, affected the speed of banking transactions, nevertheless they did not become instant.

Still need to pay attention to the fact that using the services of traditional banks, clients are often not protected from loss of funds. A bank employee may be ask a question about where this money came from, was the tax paid or not, and if you can not give an explanation acceptable to his subjective opinion - your money can be arrested indefinitely. Even if you did not violate any laws, and the bank employee simply made a mistake or showed excessive zeal - to find out all the circumstances and defrost your funds, it will take a long time during which you will not have access to your money. And this can lead to a very unpleasant post-effects. For example, due to the fact that you can not make certain payments on time in accordance with your business contracts, you will incur direct and cumulative damages.

About project:

To get rid of this kind of inconvenience, you can, if you use a decentralized financial platform, based on blockchain technology. Decentralized platforms will save you from losing money and unwanted issues, while all your money transfers will be processed instantly, and at that time you will be able to track all your funds - this decentralized blockchain was created using such technology, thanks to which no one can steal money or unauthorizedly make changes to any financial documentation.

Оne of the new financial platforms is Distributed Credit Chain. His job is to provide financial services for people. His work scheme using blockchain technology provide to use financial services to people from around the globe, no matter where in the world a person is currently located, because the platform can be used via the Internet .

Of course, blockchain technology is currently unusual for us, but after all, everything new is always unusual, despite the fact that the blockchain can many times simplify and speed up the work with finances.

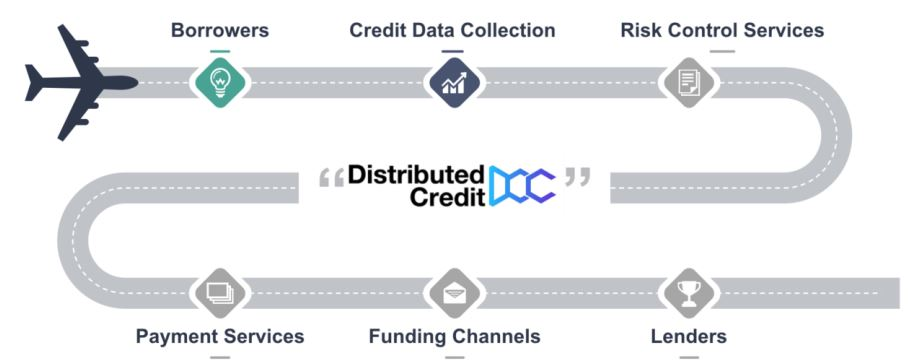

How it works:

The most important task of the Distributed Credit Chain is to create a financial structure that would be worthy of competition to banks and would deprive them of the monopoly on the financial services market that they now enjoy. This will be achieved due to a fundamental difference from the modern banking approach to working with customers. Current banks, in one form or another, always take payment for their services, but in the Distributed Credit Chain system, on the contrary, instead of paying money for the services rendered, users will be rewarded for participating in the development of the project, thus creating the necessary motivation and users will have no doubt about the benefits of using the services provided by the Distributed Credit Chain.

If we look at the project in more detail, we will see that not only technical solutions but also the structure of work are innovative. The decentralized system is good because everyone is equal in it and anyone can use the service from anywhere in the world. Also, a decentralized system will exclude the need for various intermediaries, which will make services even cheaper, and their use is even more cost-effective. Instead of using the principle of personal financial responsibility, capital management will be carried out through a peer-to-peer distributed scheme. As a result of the introduction of these innovations, we will get a higher level of protection for both clients' funds and business as a whole, and this will also increase efficiency in several times. Also, thanks to blockchain technology, the market of credit and financial services will become decentralized, hence no participant in this market, regardless of whether it has money and power, will not be able to monopolize the market, impose its rules and dictate its will to all other market participants.

Benefits:

The structure itself will work like this: all the information and financial documentation will be stored in the form of encrypted records in the blockchain, it will also be processed inside the blockchain, which means that the records can not be destroyed, altered or forged from outside. This will make the funds and personal information of customers virtually invulnerable to intruders. At the same time, users, as well as moderators with the necessary level of access, will be able to view the records and see what the status of assets and transactions is, both in the form of information coming in real time or in the form of logs in which information about past transactions will be displayed and operations. This is mechanism will allow users to quickly analyze market data and assess the level of financial risks in a timely manner to respond to their changes.

Conclusion:

The Distributed Credit Chain project will significantly accelerate and simplify the use of banking services for population, make them more profitable for all parties, allow users to make deposits or receive a loan with a single click, help to avoid queues in banks and tedious procedures for processing banking services.

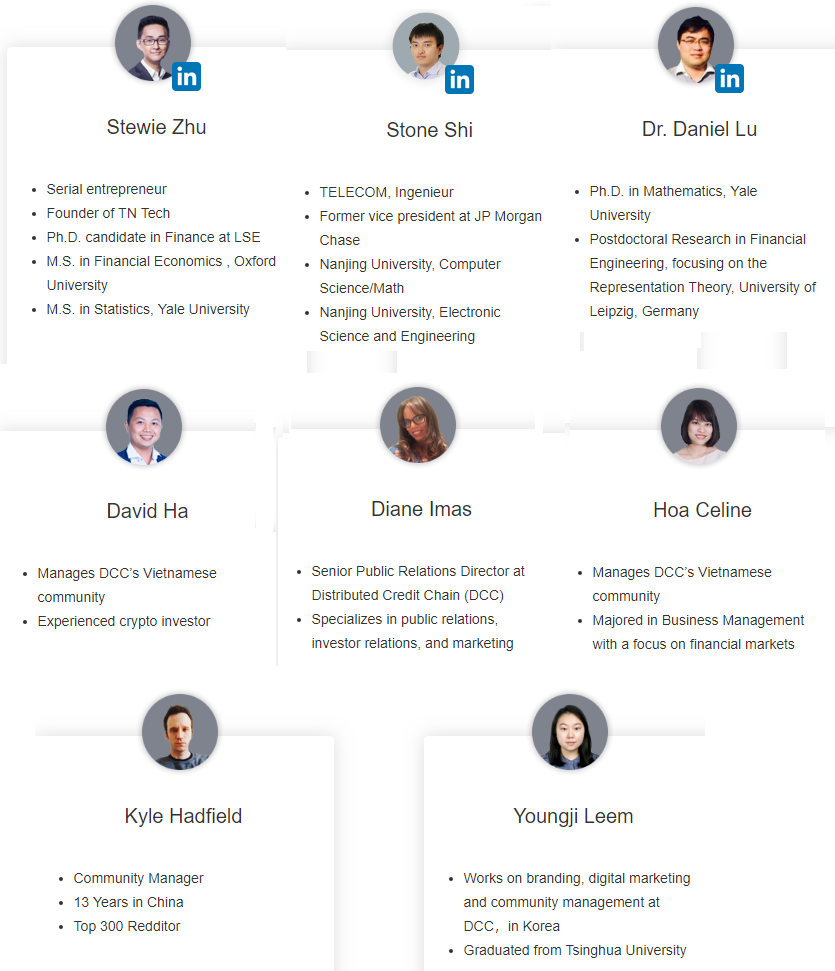

Project team:

Links:

Website: http://dcc.finance

Telegram: https://t.me/DccOfficial

White paper: http://dcc.finance/file/DCCwhitepaper.pdf

FACEBOOK: https://www.facebook.com/DccOfficial2018/

Twiter: https://twitter.com/DccOfficial2018/

ANN : https://bitcointalk.org/index.php?topic=3209215.0

Мой аккаунт на Bitcointalk: Ormandin https://bitcointalk.org/index.php?action=profile;u=1989222