BTCCREDIT - Next-Gen Decentralized Banking Ecosystem

About

Blockchain is making history by shifting power from centralized entities into the hands of the consumers. It has empowered people to manage their own assets without the intervention of any banks, brokers, or institutional monitors. This is a welcome necessity since people risk too much today by allowing their crypto assets to be controlled by a central entity. They don’t realize that it is not them but Wallets, Exchanges, & Lending Platforms that are controlling their assets. Hence, they have given up control of their identity, privacy, and money because they believe that they don’t have a choice. But not anymore. We aim to be the access point that provides people with this choice.

BtcCredit is an all-in-one decentralized wallet which gives you complete control of your Blockchain asset to Hold, Exchange, Lend, Borrow, Invest, and Stake. This document outlines the design of a Decentralized Next-Gen Banking Ecosystem that is powered by decentralised multi-currency wallet, decentralised p2p lending, and decentralised p2p Exchange capabilities.

Market Analysis of P2P Lending

It is cited, that “According to Morgan Stanley, the market for Global Marketplace Lending may reach $290bn. by 2020, with an expected Compound Annual Growth Rate of 51% from 2014 to 2020.”

The BTC Credit team is trying to showcase the potential of this market, in order to explain that their truly innovative peer-to-peer wallet solution holds great potential.

Crypto P2P-Lending

There are some existing Crypto lending platforms which are following different business models. On one end they are a just like a traditional p2p lending platform with the ability to accept cryptocurrencies as collaterals. On the other end, they deploy the entire loan contract on the blockchain and execute events on the loan agreement through smart contracts. The blockchain technology, with its fully transparent and incorruptible transaction ledger, forms the ideal system for managing the loan with its parameters like tenure, interest rate, crypto collateral, etc.

There are many platforms that offer crypto lending:

- Sofin

- Everex

- Ethlend

- Lendoit

- Btcpop

Competitive Analysis

P2P Lending Platforms can be divided into three main categories:

Traditional P2P

Lending within the same country and in that country’s currency

2Cryptocurrency without Smart Contract

Lending globally with cryptocurrencies like Bitcoin

Cryptocurrency using Smart Contract

Lending using Blockchain Smart Contract as an intermediate

How Does it Work?

As a lender, a user enters the system and funds his system generated Wallet with USDTs. The system creates a lending profile where his acceptable loan parameters are recorded. The lender’s loan profile becomes a part of a “credit marketplace”. As a borrower, the user enters the system with his system generated Bitcoin wallet. The bitcoin funds in the wallet form the collateral against the potential loan. The borrowing requirement also becomes a part of the “credit marketplace”. A system internal logic automatically matches and suggests existing loans and borrowers. A borrower or lender can also manually select from a set of loan offerings or borrower’s requirements. Once a loan is selected, and both sides agree to the parameters on the book, a “handshake” is said to have taken place, which will result in a deployment of a smart contract on the Ethereum network. The borrower’s wallet will be funded with the requested USDT and a schedule for repayment gets created.

Roadmap

Q4 2018

P2P Crypto Loan System Launch

The journey begins with Borrow-Lending, a Peer-to-Peer Crypto Loans System Launch.

Smart Contract On Ethereum

Q1 2019

USDT Lending system Launch

Users Can Lend USDT which is backed by LDT Tokens and Smart Contract

Getting Apps Available on Mobiles

Getting the Lending Platform Compatible with Mobile Phones.

Acquiring Licences

Acquiring Crypto Wallet and Lending Licences

Crypto Wallet Launch

Q2 2019

BTCC Token Listing on our Lending System.

Now users can Lend Using BTCC Tokens and can use BTCC as collateral.

P2P Exchange Launch

Peer-to-Peer Cryptocurrencies Exchange Platform Launch.

Q3 2019

Staking Plan Launch

Staking plan launch for investor, who will be benefited with interest on BTCC / BTC hold as staking

ALT Coins Lending and Colateral

Now users can Lend Using Alt Coins and can use Alt Coins as collateral.

Q4 2019

Crowd-Funding Platform

Peer-to-Peer Crowd-Funding platform

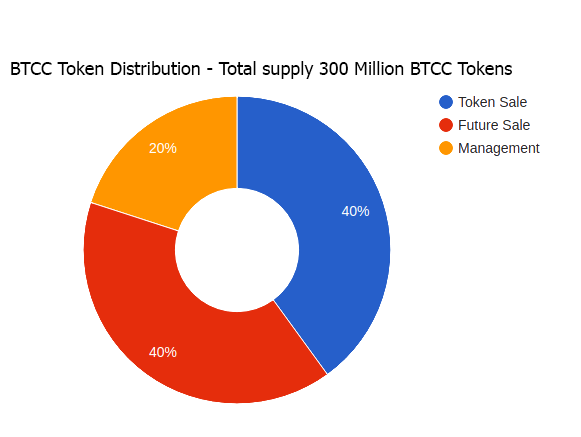

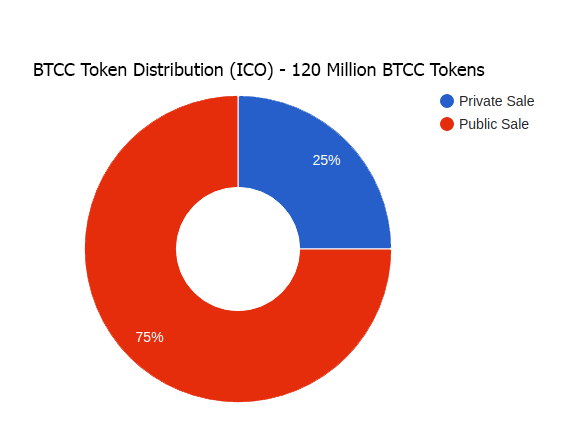

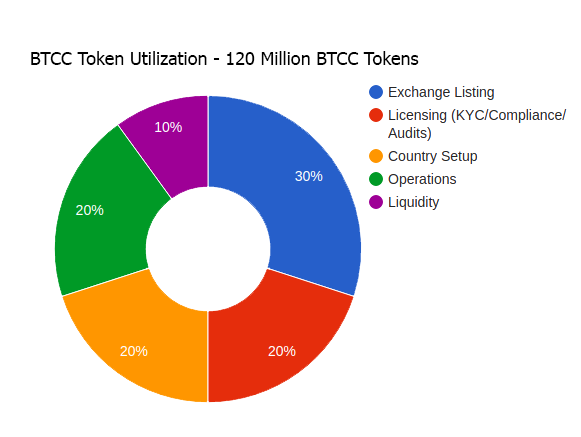

Token Distribution

Team

Shrirang Muley: CEO

Kirankumar Kapure: CTO

Mayur Shrivastav: COO

Advisory Team

SANG JAE SEO: CEO, Payx

JASON H.JUNG

For More Information Click Link Bellow:

Website: http://btccredit.io/

Whitepaper: http://btccredit.io/pdf/btccredit_whitepaper.pdf

Bounty ANN link: https://bitcointalk.org/index.php?topic=5135102.msg50733865#msg50733865

Telegram: https://t.me/btccredit1

Facebook: https://www.facebook.com/BTCCredit-1017662868433011/

Twitter: https://twitter.com/btc_credit

AUTHOR:

MY BITCOINTALK USERNAME: dama1234

MY BITCOINTALK PROFILE LINK: https://bitcointalk.org/index.php?action=profile;u=2591573

MY ETH ADDRESS: 0xA23098b95C8F39ED772a7Cb363C791FeB14ED464