Q DAO Platinum Review

Cryptocurrencies offer a wide range of benefits for users around the world. However, high volatility in their prices prevents mass adoption. Users are not willing to trade in digital assets that might experience huge price changes in just a couple of minutes. Even the most popular coins, such as Bitcoin and Ethereum, aren’t able to deliver stability with price movements for up 20% being a usual occurrence.

What is Q DAO and How is work:

http://tokensale.qdao.io/

Q DAO is a blockchain platform, integrated with Ethereum smart contracts. It provides a number of enablers for sustainability of the generated stablecoins, such as CDPs (collateralized debt positions), automated price adjustment processes with feedback mechanisms, as well as a system of incentives for external actors.

The user registers at Q DAO Platform. The user needs to specify only the email, so that the ecosystem can furnish notifications on important events. In this way, we assure a high level of anonymity. The user receives the wallet and 3 private keys (private key to user’s BTC wallet, private key to our network and private key to Ether network (with the last key provided optionally)), used to access various functions within the ecosystem.

The user transfers a required amount in BTC to their BTC wallet within the Q DAO Platform. Then, the user sets the desired parameters for the loan to be obtained.

The ecosystem checks the availability of the required amount of the collateralized assets (for instance, Bitcoins, which the user has previously collateralized within the system). Upon a successful completion of the verification, the ecosystem mints the respective amount of USDQ and furnishes the same to the user’s wallet. Now the user can utilize the received stablecoin as he wishes.

Subsequently, the user can adjust the collateral depending on the changes to the collateral price. Should the collateral’s price go down, the user must add up the collateral or repay a portion of the USDQ-denominated loan. If the user fails to take any action, the ecosystem will perform the forced liquidation process. Should the collateral’s price go up, the user can increase the USDQ-denominated loan amount, withdraw a portion of the collateral or avoid taking any action at all.

The user furnishes a request to the ecosystem for the funds withdrawal. The user should repay to the ecosystem the earlier received USDQ-denominated loan and the Stability Fee, which accrues throughout the loan term and payable in Q DAO token. The user utilizes the private key in order to sign the transaction, enabling the user to get the collateral assets back to his wallet.

Benefits

Any person can use Collateral Assets in order to create USDQ at Q DAO Platform. They do this by interacting with a special smart contract, identified as “Collateralized Debt Position”. The Q DAO Governance, made up by holders of the Q DAO governance token, is charged with making decisions on Collateral Assets, allowed for the use.

At the Q DAO Platform, users can generate various stablecoins, currently USDQ and KRWQ are available. USDQ uses Bitcoin as its collateral, i.e. in order to create USDQ users need to lock up their Bitcoins in a smart contract. The stablecoin’s price is pegged to United States Dollar. Stablecoins are seen as an important enabler, paving the path toward mass adoption of DLT-powered digital currencies. In contrast to other stablecoins on the market, USDQ is fully decentralized with all of its components residing on top of the blockchain. The KRWQ (and other stablecoins, planned to be launched in the future) act in the similar way, but are pegged to their specific fiats (KRW for KRWQ). In order to simplify the description, we are referring below only to USDQ, but the reader should understand that the same always applies to all other stablecoins, such as currently available (KRWQ) and planned (CNYQ, JPYQ and others).

Any person can purchase and sell USDQ via exchanges, brokers or OTC deals. It’s an ERC20 token and brings a convenient ease of transfer without any limitations of any kind. USDQ holders can earn additional profits, receiving the Savings Rate, accruing on their holdings.

USDQ delivers an effective solution for a stable value exchange method within the blockchain economy. Internal processes for USDQ generation, transfer and withdrawal, coupled with robust risk management solutions, invigorate the architecture to bring scalability, flexibility and sustainability. The development roadmap enables to focus on agile development in the short term with subsequent plans to deliver genuine decentralization. The ecosystem seeks to spur mass adoption, while always acting in a balanced and responsible manner.

Price Stability Solutions:

The Target Price for USDQ means the price, used to determine the value of the Collateral Assets, repayable to USDQ holders upon an Emergency Shutdown. USDQ features a soft peg to USD, meaning that a 1:1 peg is maintained most of time but some deviations might occur on occasion. The Target Price for 1 USDQ is 1 USD.

Q DAO Platform is effectively protected against any large-scale attacks on its infrastructure with the Emergency Shutdown being the measure of last resort. Upon activation, the Platform terminates all of its operations and subsequently redeems USDQ holders and CDP operators for the net value of assets they have a claim for. USDQ holders are entitled to receive the value in Collateral Assets, equal to the USD-denominated amount of USDQ units they held. During the Single-Collateral USDQ, the Emergency Oracles, elected by Q DAO holders community, manage the process for the Emergency Shutdown.

Q DAO Token Governance

Q DAO token is essential to governance mechanics, implemented within the Q DAO Platform.

Q DAO holders participate in the votes for an Active Proposal, submitted by Q Box (neural network component) or Q DAO holders. The Active Proposal is a smart contract that can access the ecosystem’s parameters and make the changes, specified in the proposal.

The vote by the Q DAO holders community is held with regard to the Active Proposal. With regard to the proposals, brought forward by Q Boxes, the users who are inclined against the Active Proposal have to cast the “no” votes with their Q DAO tokens being burned upon the vote. A user who doesn’t vote against the Active Proposal is deemed as voting in favor of the same. The votes must be cast within 24 hours from the time when The Active Proposal was placed on the vote. Meanwhile, the Active Proposals, furnished by Q DAO holders, move through a conventional voting process with Q DAO holders voting for or against the proposals.

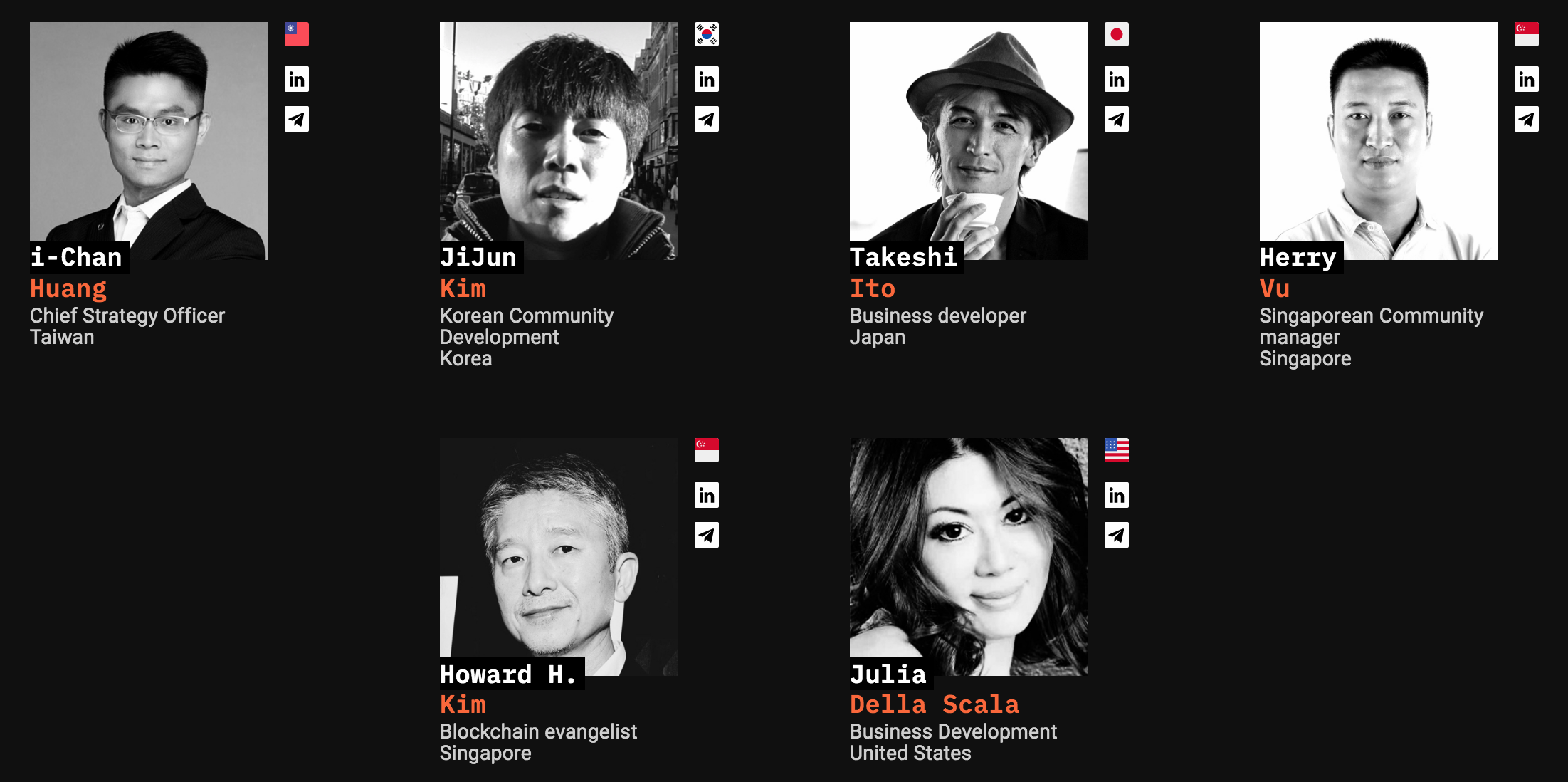

Advisers

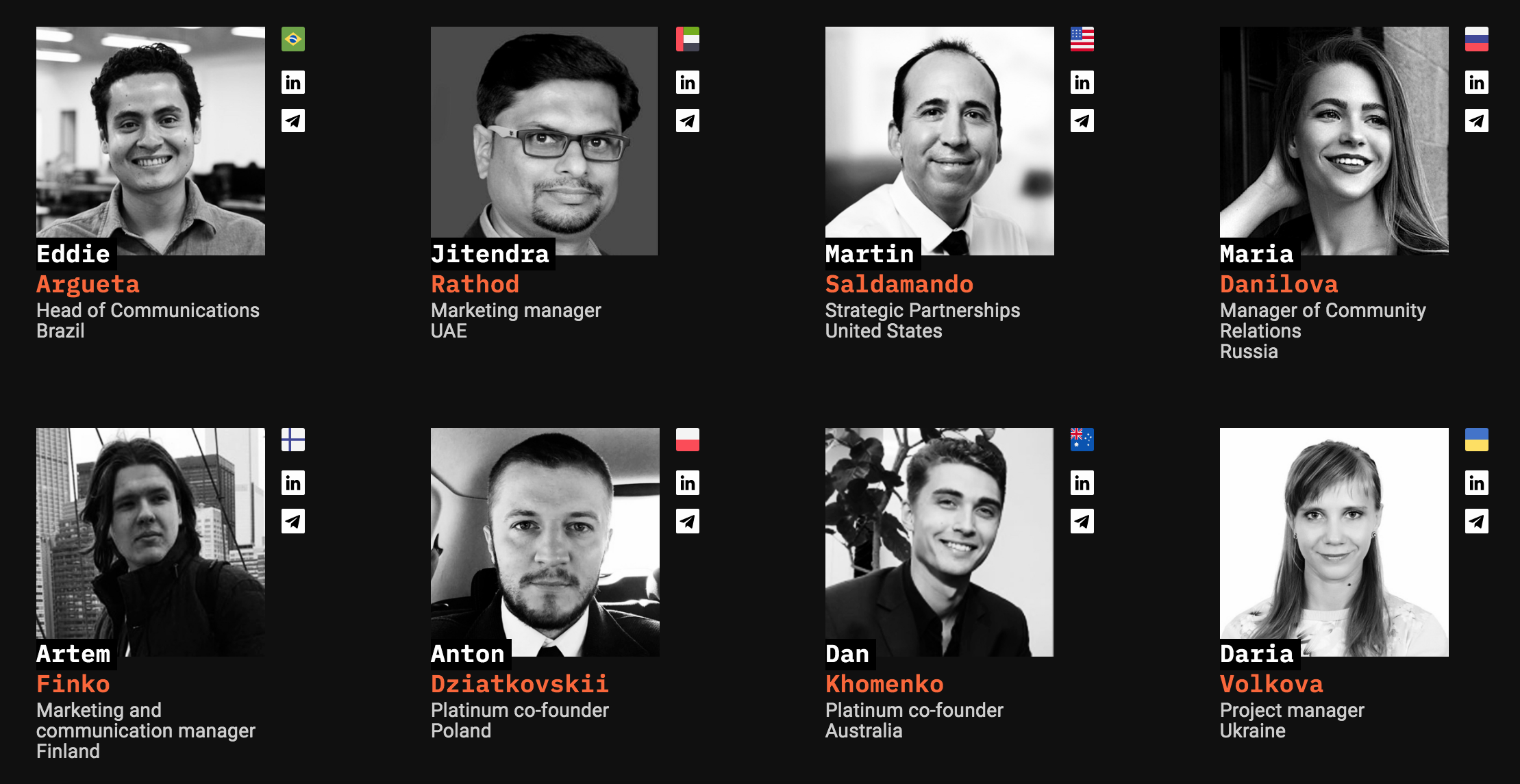

Management team

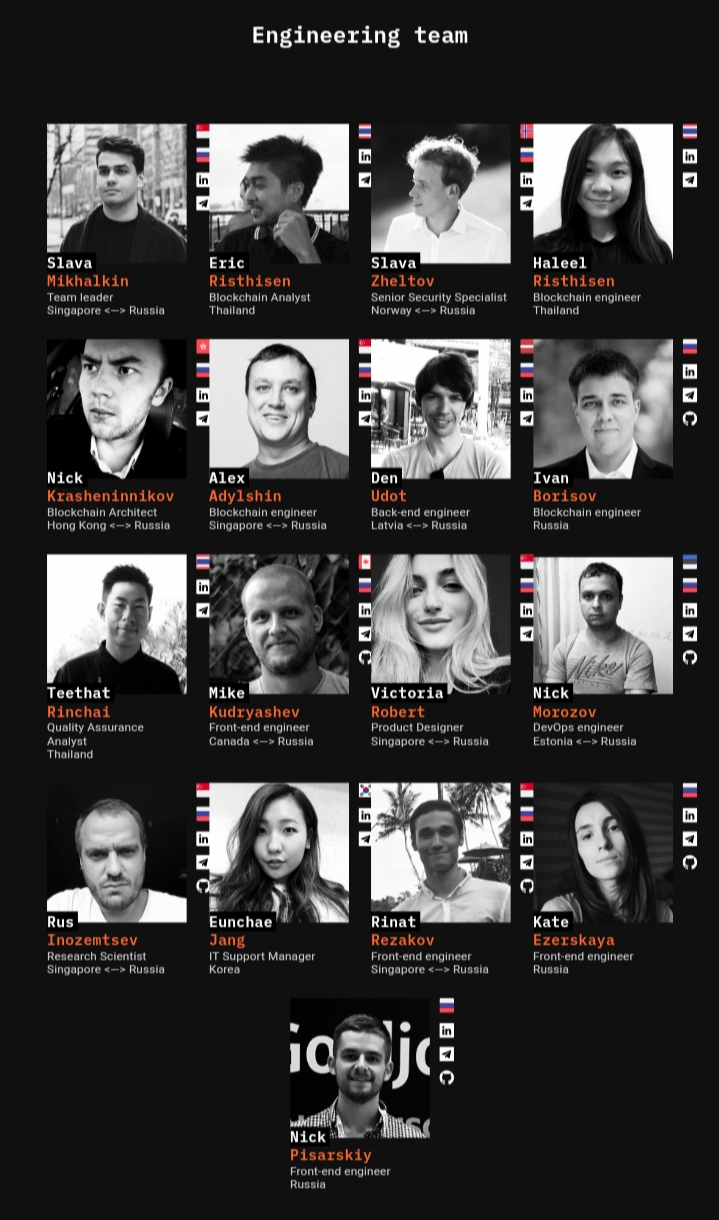

Engineering Team

More information on the project USDQ network please visit their website listed below:

♦ WEBSITE: https://usdq.platinum.fund/

♦ WEBSITE: https://platinum.fund/sto/

♦ WHITEPAPER: https://usdq.platinum.fund/%201-200%20USDQ%20/whitepaper

♦ ANN: https://bitcointalk.org/index.php?topic=5139238.0

♦ TELEGRAM: https://t.me/PlatinumQeng

♦ TWITTER: https://twitter.com/platinumqdao

♦ FACEBOOK: https://www.facebook.com/FundPlatinum

♦ MEDIUM: https://medium.com/platinum-fund

♦ AUTHOR:

♦ BTT Username: dama1234

♦ BTT Profile link: https://bitcointalk.org/index.php?action=profile;u=2591573

♦ ETH Address: 0xA23098b95C8F39ED772a7Cb363C791FeB14ED464