Lendingblock

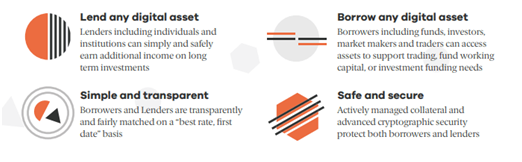

Lendingblock is an open exchange for crypto currencies, where borrowers and creditors are collated in a simple, safe and transparent way. The lending unit creates an infrastructure for future cryptoeconomy.

Lendingblock is an agreement and stage designed to enhance the opportunities and support for obtaining and lending within a crypto-budgetary framework that brings monetary benefits of borrowing to a dispersed blockage economy. Lendingblock creates a market and monetary basis for crediting securities in cryptoeconomics. The evaluation of securities on credit in the commercial center for securities lending in 2017 amounted to $ 2 trillion, which is 12% of all available shares and bonds. It is normal that the market of cryptographic forms of money and advanced resources will be used after comparative development in the markets of confirmation for respect for financing, but with a faster selection rate taking into account the straightforwardness and smoothness of the market.

Lendingblock will be a transaction that is aimed at supporting cryptresources, which addresses the issues of institutional and individual borrowers and loan specialists in cryptoeconomics. Lendingblock allows you to pass the cross-lock value to the criptocredit market. Lendingblock will launch with Bitcoin, Etherium. The funds are stored in cryptographic escrow between various block chains issued under ephemeral contracts, which contain information on the loan agreement.

Lendingblock will become the main transaction aimed at supporting cryptresources, which addresses issues of institutional and individual borrowers and loan specialists in cryptoeconomics. To ensure transparent cross-chain lending from day one, Lendingblock uses oracles to provide reliable guarantees for starting lending, collateral management and repayment. By embedding the oracles as code run inside the Intel SGX enclave, Lendingblock can provide cryptographic evidence of the block chain that it has executed a specific piece of code with data inputs.

Lendingblock creates a market and monetary basis for crediting securities in cryptoeconomics. The valuation of securities on credit in the commercial center for securities lending in 2017 amounted to two trilion $, which is 12% of all available shares and bonds. The market of cryptographic forms of money and advanced resources will be used after comparative development in the markets of confirmation for respect for financing, but with a faster selection rate taking into account the straightforwardness and smoothness of the market.

Lendingblock will also use API tools for institutional and professional traders. Lendingblock API will provide public data on books for ordering orders, tariff tables in different currencies, information about the user account and the possibility of placing requests for credit. More users will have access to payment terminals for paying interest and principal payments.

Stages of the Borrower:

- first registration takes place in which potential borrowers create an account and complete the verification and verification of the identity;

- Then there is a specification in which borrowers fill in profiles that indicate the details of the loan they are looking for (the main asset, the amount of principal, duration, maximum interest rate and collateral). After that, it is checked that the deposit is available to prevent false offers, then it is automatically compared with the lending proposals;

- further there is an initiation, this is when the borrower places a pledge in the LND smart contract and expects the lenders to place the principal in the intellectual contract until the loan amount is reached;

- then a service whereby the borrower makes planned payments that are distributed to creditors under the LND Smart Contract and, as necessary, adjusts the amount of the security to reflect any change in value;

- and in the end, completion, this is when the borrower completes repayment of the principal amount of the loan, which is returned to the creditors, and the collateral is returned to the borrower with the help of the LND smart contract or, in the event of the borrower failing to fulfill the pledge, is being extended by the creditors to cover their investment.

Stages of the Lender's functioning: - First registration takes place in which potential creditors create an account and complete the identity check;

- Then there is a specification in which the creditors first fill in the profiles, determining what they are looking for (how much they want to borrow, the period, the desired minimum interest rate, collateral). After that, it is checked that the lender is available to prevent false offers, then the lending proposal is automatically compared with the loan profiles that meet their requirements;

- further there is an initiation in which, as soon as the borrowers have provided a pledge, the creditors place the principal amount in the loan agreement Lendingblock, after which the principal is sent to the borrower;

- then there is an operation in which the lender receives the planned interest payments from the LND smart contract;

- and in the end completion, when the creditor receives repayment of its principal amount or in case of default by the borrower receives a pledge to cover its investments.

Useful links about the project:

http://lendingblock.com

https://whitepaper.lendingblock.com/#abstract

https://twitter.com/lendingblock

https://www.facebook.com/lendingblock/

http://t.me/lendingblock