AMANPURI: Ultimate Exchange

AMANPURI has collected involvement in the high influence FX field for a long time, however there were numerous non-authorized FX intermediaries occupied with bucketing amid the creation time of FX. As of now, the majority of them have been gotten rid of, however it gives the idea that this equivalent circumstance will happen in the VFA business starting now and into the foreseeable future. It is the clients and the speculators who endure these sorts of harms, for example, misty exchanges, contract dissents, startling server down time, withdrawal refusals, correspondence breakdown with a client bolster group and abrupt closings. AMANPURI will infuse assets into both influence and spot exchange and request coordinating frameworks and advertising to raise the exchange volume and ensure client resources. Also, AMANPURI will endeavor to accomplish the world's biggest exchange volume with assistance from experienced advertising methodology experts. Starting now and into the foreseeable future, clients are requesting an all the more earnestly and sincerely overseen trade.

Problem

The activity of the DLT trade gives the VFA's exchanging platform as well as a multifaceted administration business fixated on giving impermanent capacity of client resources, data and client support. As the quantity of clients increments, so as to secure in the client, it is important to give a situation that can be utilized all the more securely and dependably. As a general rule, the present trades have numerous issues.

Solution

The AMANPURI Exchange builds up a DLT trade with up to 100x influence exchanging platform as its fundamental administration through a spot exchange platform and request coordinating framework with client resource assurance at the top of the priority list. You can get an extraordinary idea of a half decrease of the exchange expense by utilizing the restrictive issue VFA AMANPURI token (AML) for the installment of exchange charges.

Multi-sig

AMANPURI depends on a multi-sig advanced mark conspire. At least two passwords (mystery keys) are required for the settlement of VFA from a Wallet Address. One of the impacts of this security highlight is that, for DLT trades, just by utilizing multi-sig, programmers will in general abstain from hacking the trades. Moreover, through administration with a chilly wallet, client resources are shielded from the risk of programmers.

Cold Wallet Management

Fundamentally, client resources are kept in a cool wallet which shortens the dangers related with hacking. Besides, concerning withdrawal systems, we limit withdrawals to one every day, and arbitrarily choose the time span amid which strategies are brought out each time through our own calculation. Through consistence and this current calculation's extraordinary sporadic changing of timings, we offer total security. As a benefit holding activity, ensuring client resources is our first need. Concerning every withdrawal application, it won't be managed independently, for instance, if there were to solicitations of withdrawals from 100 records, they will be prepared together. This can go about as a countermeasure against hacking.

Partnerships with Custodians

At present, we are experiencing dealings with a noteworthy caretaker that is a permitting organization of the British FCA so as to oversee client resources independently. We intend to begin a trust concurrence with our overseer around 2023. At the point when overseers are assaulted through things like hacking, the Bank of England remunerates them for the harms, so we can by implication secure client resources 100% regarding the independently overseen reserves.

Pool

Exacting administration of the multi-sig signature and cold wallet, and safety efforts, for example, organizations with overseers will be done, and also, we intend to pool 5% of the month to month working benefits as assets exclusively to cover client resources in case of harm brought about by assaults. Until we have achieved a joint concurrence with our overseer, we will pool supports set at 7% of the working benefits to shield client resources from all dangers.

ICO Details

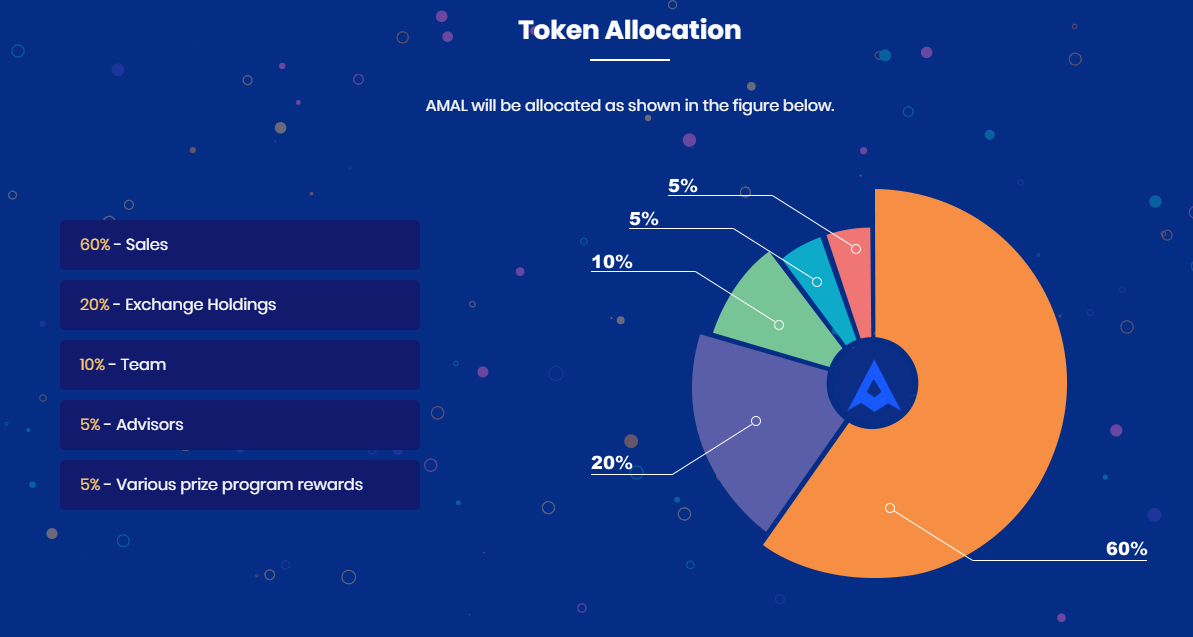

AMANPURI's ecosystem is upheld by AML utility tokens. The AMANPURI token (AML) is an ERC20-agreeable token issued in the Ethereum blockchain and can be utilized for exchange charges, posting expenses in the AMANPURI Exchange and utilized for venture goals, for example, trades with VFA and so forth. In addition, there is likewise the likelihood of moving to a unique blockchain in 2020.

For More Information:

Website | Whitepaper | Telegram | Twitter | Facebook | Reddit

Author's Info:

Bitcointalk - Connect08 | Uniqueness 100%

My ETH Address: 0x63694AF8F3228C1F69c3CB81664106C16D090174